A market in stand-by

22 August 2016Paola De Pascali visited Vertikal Days, shortly before the Brexit vote, and found many crane manufacturers and dealers expressing their concerns over the uncertainty the referendum had caused. Even after the vote, many investors are taking a “wait-and-see approach” and putting big projects on hold.

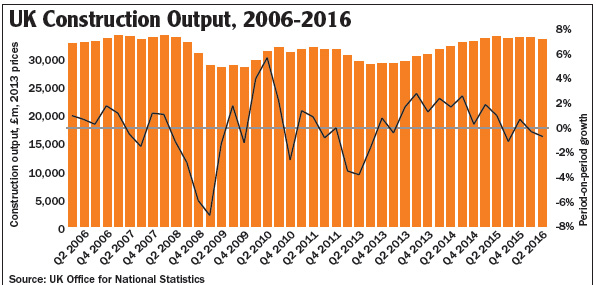

The UK construction market continues to slow down, as Brexit uncertainty delays investment. As this piece was being edited, the UK Office for National Statistics announced a fall of 0.7% in construction output in the second quarter of 2016; in the preceding quarter, output had fallen 0.3%. This decline, two quarters in a row, fits the technical definition of a recession.

According to the Markit/CIPS UK Construction Purchasing Managers’ Index, an economic indicator based on polling of managers buying intentions, there has been a “clear loss of momentum” after the EU referendum. The index registered July data at 45.9, down fractionally from 46.0 in June and below the 50.0 ‘nochange limit’ for the second month running.

The survey revealed the steepest fall in commercial building for over six-and-a-half years, alongside a drop in civil engineering activity for the first time in 2016. Residential construction also declined at a solid pace in July, but the rate of contraction eased from June’s three-and- a-half year low.

Markit senior economist Tim Moore said, “Construction firms generally suggested that clients had adopted a ‘wait-and-see approach,’ rather than curtailed or cancelled forthcoming projects during July.

“Latest data showed that confidence regarding the year-ahead outlook eased further following the EU referendum, but only to a level last seen in April 2013 and one that is still well above the record lows experienced in 2008/9.”

Richard Threlfall, head of infrastructure, building and construction at KPMG UK, commented on the index results: “Businesses need to start planning for possible scenarios including new tariffs and trade restrictions, pressures on wages and labour availability, and a deterioration in public finances.”

David Noble, group chief executive officer at the CIPS, said: “The picture is still unclear around whether this direction is fixed for the coming months or is a short-term reaction and the aftershock of the UK’s referendum decision.”

Kobelco’s sales manager Mark Evans spoke to Cranes Today after the Brexit vote. “The UK market has been a little bit quieter over the last couple of months and the exchange rate has dropped since the Brexit vote. Customers don’t like uncertainty and some investors have put on hold some projects.”

Ahead of the Brexit vote, UK crane firms at Vertikal were already seeing uncertainty. Paul Johnson, managing director at G H Johnson Crane Hire and Kobelco’s customer said: “The last two years were exceptionally busy and this year it’s a natural slow down. When the market is busy, everyone wants to buy, conversely when it slows down everyone thinks carefully before taking a decision.”

Evans explained, “The market is not dead. We are still having a good year, managing a reasonable number of orders and deliveries in the UK.

“The most popular Kobelco cranes in the UK are the CKE 900, CKE 1100, CKE 1350, CKE 2500 and the new G2 series versions. There is good demand or these types of machines. The biggest advantage of the G2 series is the Tier IV final engine that can provide fuel savings and low emissions, enabling these cranes to operate in central London.”

Evans said Kobelco cranes are sold across the country: “A large proportion of cranes are in and around London because the Greater London area accounts for 20% of the UK population and an even higher percentage of business, roughly 30- 40% of UK business is in this region.

However, there are a number projects outside London that also require modern machinery.”

Edward Carr, operations director at Hewden Crane Hire, said they’ve been investing back into the UK mobile cranes market for the past couple of years. “Most recently we invested £11.5m on more than 20 Tadano cranes to extend our lifting capabilities up to 220t,” he said.

This year Hewden acquired Interlift, enabling it to provide material handling and lifting accessories from the company’s depots, primarily in the North East of England. Hewden has since started to rollout Interlift sites across the Hewden network with the aim of a national rollout.

“Until now we have primarily invested in new cranes, but we are now looking at different products, such as Interlift, to help better penetrate the market and improve our overall offering to customers,” Carr said.

Hewden purchased two units of the ATF 220 G-5, which is offered with an optional telescopic fly jib. Carr explains, “We wanted to bring this machine into the UK market because we were looking for an innovative crane. The main advantage of this telescopic jib is that it enables objects to be lifted beyond building edges and be telescoped into building structures with a ceiling, previously not possible with rigid boom extensions. It can also reduce the minimum radius.”

Lee Maynard, sales director, Europe & Russia CIS at Terex Cranes, said the UK and Irish crane rental market is very busy at the moment.

He said: “We are promoting the new family of five-axle all terrain cranes, which is an attractive range for these markets, especially the AC 220- 5 with its industry leading 78m boom. Also populart is the AC100-4L with its 60m boom and compact 2.55m width on 16.00 tyres.”

Terex has also launched into the UK market the new AC 40/2L, with a newly-designed carrier cabin. It has already received a significant number of orders for this model.

Maynard said: “We’ve seen very good activity in the UK for large crawler cranes with the first two CC3800 (650t class) cranes already delivered.”

Machinery Movement Crane Hire has a number of Terex products in its fleet. “We are happy with their quality and we know we can rely on their after sales service,” said Carl Philips of Machinery Movement Crane Hire.

At the show, Philips said, “[The UK market’s] not as busy as usual, but I hope it will start to improve shortly because there are a lot of projects coming up in the near future.

“For example, there is a new project for a railway bridge in the South Wales. Unfortunately, the steel market is low and that’s a shame because a lot of cranes are required in that sector.” Conversely, he said the market is going well for general construction.

Steve Barnett, commercial director for the UK, Ireland and Scandinavia at Manitowoc, said over the last decade, the UK construction market has grown and since the referendum, signs remained positive.

“In the last three years, we have had great success with Grove cranes, especially the GMK6300L, and we are hoping for the same level of success with the new models, for example, the GMK5250L and the GMK3060,” he said. “We are aiming to launch them into the market this year in addition to the GMK5150 and the GMK5150L as well as the new four-axle crane, the GMK4100L-1.” Liebherr-Great Britain managing director Richard Everist said, “Compared to three years ago, the UK market is strong and we are still in a good position.There is a growing demand for heavy equipment and there are a number of construction projects which haven’t started yet but we hope are imminent. We anticipate steady demand for cranes.”

Everist said, “The recent launch of the LTM 1450 at Bauma received very good feedback. Sales of this model will be strong in the UK as not only does it have a very long boom, it is also able to travel under [UK special vehicle type regulations] with its complete telescopic boom and supports.“From January 2016 until now (June 2016) Liebherr-GB has sold 100 mobile cranes, across the range, into the UK and I am very positive about the future.”

Koos Spierings, sales engineer for the UK at Spierings, said the company is currently using all its production capacity for two models of crane: the four-axle SK597-AT4 with 48m radius and the renewed six-axle SK1265-AT6 with 60m radius. They are both equipped with Euro VI engine compliant to the new emission legislations.

Spierings said, “The particular concept of the mobile tower crane is getting popular in the UK. By putting tower cranes on wheels, we’ve developed a real all-rounder which can be used in more than 80% of lifting jobs. The demand for these machines is growing and more than 60 mobile tower cranes are already working in the UK.”

Daniel Hieronimus, area sales manager from Liebherr’s tower crane factory in Biberach, Germany, said the UK market is very important for the company.

He said: “We plan to extend our rental fleet of top-slewing cranes, especially luffers, which are popular because of the UK’s oversailing laws.”

“Our MK 88 and MK 140, which were exhibited at Bauma and Vertikal Days, are proving very popular. This five-axle model, which provides massive radius and load capacities is very compact in size. A number of MK 140s have been delivered since the end of 2015 and feedback from the customers has been extremely positive. The MK 140 has a full luffing mode and the MK 80 has optional jib angles, for more flexibility on-site and to avoid oversailing.” Manitowoc has launched a new series of self-erectors, showcased at Vertikal Days with the new Hup 32- 27. This has a maximum capacity of 4t, and thanks to its novel unfolding movement, can be set-up even in the most congested spaces.

Dave Rees, operations manager at NRC Plant Ltd, the UK distributor of Link-Belt and Hitachi Sumitomo cranes, says the UK telescopic crawler crane market is huge and set to grow bigger.

“Customers demand ‘green’ eco-friendly machines. Our latest fuel efficient engines machines like the 127t TCC 1400, come equipped with the latest Tier IV Final Engine compliant to the UK emissions restrictions,” Rees said.

“We purchased this particular model from Link-Belt to complement our own rental fleet and we have a number of units arriving available for sale. It’s a class-leading crane with 59.5m full power boom and Link-Belt’s latest one person operation stowable bi-fold fly jib. An array of track width and counterweight configurations allow for the crane to be used in any jobsite.

“Some industries are looking to telescopic crawlers to replace conventional lattice boom cranes, however I feel there is still a market for lattice boom cranes where capacity or strength is required.” Speaking at Vertikal days, before the Brexit vote, Rees said, “It’s affecting current rates and investors are thinking carefully before making important decisions, there is some hesitation as they wait to see how the market will evolve in the coming months.

“Since mid-2015, we have sold 11 Hitachi Sumitomo Cranes in the UK. I feel positive about the future.

There are a number of large projects in the UK that will be starting at the end of 2016 and into 2017 regardless of the Brexit result. These include the High Speed Rail Link from London to the North of England, London’s new “Super Sewer” Thames Tideway, and Nuclear Power Station projects at Hinckley in Somerset and Wylfa in Anglesey.”

Christian Strasser, sales manager at Sennebogen, said investment in the construction market is low, but the company has a very good level of enquiries for its telecrawlers.

“These machines were placed in a niche market, but are now in a strong segment. We’ve been dealing with AGD for several years, with good results.”

“The 643 R is very popular in the UK thanks to its European design approach and we’ve already sold 20 units this year. Even though there is uncertainty in the market, I would not blame Brexit so much for any slow decision, it’s just a general uncertainty. The major factor is exchange rates and this is not just a problem with the UK, but with every country that has a different currency.”

Nick Williams, director at Martin Williams (Hull) Limited, said they are delighted to be the sole UK importer for Effer truck mounted cranes.

“Since taking on the Effer brand we have seen an unprecedented demand for the larger models, with the Effer 685, 955 and 1405 proving very popular. Effer has long been associated with large cranes and stabilisation solutions not seen on any other brand. This opens up many opportunities to supply cranes that allow customers to be to complete jobs in areas with restricted space. For instance we’ve recently mounted an Effer 955XV 8s + 6s on a MAN chassis. This is a unique combination of the Effer CroSStab base crane rear mounted with the Vstab leg system at the front giving the customer a true 360° 100% lifting capability.”

“The quality and range of Effer products allows us to meet the requirements of many different sectors. We’ve sold 40 units into the UK market and this is our first year as Effer’s UK partner, so we have very high expectations for the coming years. Our business has been built on quality and aftersales commitment, which we have carried through into the Effer side of the business. We have trained 14 engineers on two training courses already this year and also invested in new service vans and a large parts stock to ensure our customers not only get a quality product but the back-up required in the demanding British market.”

PM, part of Manitex International, showed at Vertikal Days some of its most popular truck-mounted cranes in the UK market.

“The most popular models are the PM 53025 SP of 53t/m, mounted on DAF truck and the 65026 SP of 65 t/m, mounted on Volvo trucks,” said Marco Castiglione, Europe sales manager at PM. These cranes can be used for heavy haulage.

Castiglione explained, “We have been selling our products to the UK market for several years. At the moment we are pushing the medium high range from 53 to 210tm. Even though the UK is very competitive, PM is one of the most important players. In the last five years our market share has grown annually by 15–20%.”

Japanese manufacturer Kato recently launched a new series of cranes, complying with European engine regulations. The company’s official European distributor Rivertek showed three new city cranes at Vertikal Days. This was the first show at which the Kato CR-130Ri, Kato CR-200Ri and Kato CR-350Ri were on display publicly.

Ivan Bolster, operations manager at Rivertek said: “The return of the famous Kato brand is the product of a joint initiative between Kato and Rivertek. We have initially reintroduced this European compliant city crane range into the Irish and the UK market.

“Kato cranes are extremely versatile and are ideal to work indoors and in confined spaces due to their compact boom design.” Bolster said Rivertek Services also stocks a wide range of used cranes, which it sells fully serviced and delivers to customers.

“Since the official Kato launch in September 2015, we have delivered over 25 new Katos to customers. We are opening a UK depot for sales and support in Cannock, Staffordshire later this year. We have the complete range of the new Kato city cranes in stock and that means customers can view and operate these cranes at our facility without having to buy from a brochure or a catalogue.

“During the show we’ve had extremely positive feedback from customers, who are delighted that Kato Cranes are back on the market.

Some customers still operate older Kato Cranes in their fleets, which have proved to be of excellent build quality, extremely reliable and hold impressive resale values even after years of service. It is a great opportunity for these customers to invest in Kato’s latest technology combined with their industry leading quality, reliability and resale value.”

Trevor Jepson from City Lifting said the market for articulated jib cranes is booming. These cranes are uniquely suited for London’s compact environment and over flight restrictions.

Jepson says, “We are the only crane hire company to have the Raptor cranes from Artic in the UK and these cranes are already working in the most expensive areas of London.

“During the night in London we have the capability to leave cranes at a 4m out of the service radius.

Where ordinary luffing cranes and tower cranes can’t operate, these Artic cranes can work in very confined spaces. For this reason there is a strong demand for this type of cranes in the UK.”

At Vertikal Days they launched a system to rescue drivers from tower cranes’ cabins.

“If the driver is ill in the tower crane, we have found an easy way to bring down the driver very quickly,” Jepson said. “Nowadays the only way to help drivers is to climb there and of course it’s dangerous and takes a lot of time. We are going to sell this system to other crane hire companies.”

During the show Jepson also commented on Brexit, saying the UK construction market is still very busy, but there is no certainty how long it will last.

“As crane hire companies, we need to be conscious before buying many cranes,” Jepson said. “If the market goes down, we have to make sure that we have enough work to pay for cranes.”

He also explained, “We purchase mobile and tower cranes from Linden Comansa, Terex, Spierings, Liebherr and Tadano. We’ve had positive returns from the rental business”.

GGR’s marketing manager, Daniel Ezzatvar described how the UK market is evolving for mini cranes.

“There is demand for this type of equipment in a variety of markets,” he says. “Their versatility makes them suitable for a number of applications and this is where our experience makes the difference.

Of course, specialist equipment requires specialist knowledge in order to provide the best service to our customers. Our expertise allows us to continuously invest in new innovative equipment and remain ahead of the competition.”

Ezzatvar said they supply a mix of spider cranes, pick and carry, crawler cranes, glass vacuum lifters and glass handling equipment. “We respond to customer demand and work with our global supply chain to develop products to meet the requirements of the industry.

Spider cranes, for example, are ideal for use within restricted spaces for a variety of applications, such as machinery removal and maintenance, to steel erection, marine lifting and restoration projects.

“To give an idea of scope of these products, we used the URW-706 to glazed the top section of the Shard. This is testament to both the capability of these machines, but also our expertise as a lifting specialist.”

At Vertikal Days Italian spider and pick and carry manufacturer Jekko launched the new SPX1275 mini crane. It offers innovative features such as a virtual wall anti-collision system, a power pack, and electronic load moment indicator.

Jekko appointed JT cranes as its sole UK distributor to introduce mini cranes into the British market. Russ Taylor, managing director of JT Cranes, said: “We signed the deal last March and we aim to initially target the market for larger spider cranes with the SPX1275, SPX1040 and SPX527, and the new SPK60 crawler crane. JT Cranes will cover the entire market, providing sales, support, service and replacement parts.”

“It’s a good time for mini spider cranes because people understand the alternative views for small cranes to work in congested sites and lifting higher capacity at the same time. We can do a lot of work with these types of machines that traditionally had to do with larger cranes.”

Taylor also said there is high demand for low emission machines.

“Jekko mini cranes are battery powered. What’s a revolution for the market, is that can be charged in just one hour instead of a standard eight. This technology is expensive at the moment but the prices will come down, becoming more accessible for everybody.”

About Brexit, Taylor said they are not concerned because business is still going on. “Companies can adapt to the market to keep trading as usual.

“Until now we have in our fleet two units, one has been delivered for Vertikal Days and another one will be delivered in October. Two other mini cranes are coming in the future, one will be delivered this year and another one next year.”

On the Kranlyft UK stand there were displayed seven models of mini cranes including the latest Maeda, the 8t MC815. This was one of a two-crane order placed by Lift Ltd Leicester at Bauma.

The MC815 goes into full production in September with the first units due to be delivered March 2017. At the time of going to press, Kranlyft UK sales director Alan Peck confirmed they had sold 17 units.

Also on display was the MK1033, a unique six-boom sectioned knuckle crane which has 3 sections to the mid knuckle and a further 3 sections. The crane was generating a lot of interest.

Over the 2 day exhibition Kranlyft secured orders for 6 Maeda cranes, 3 units models MC405 , MC305 and MC285 to Bamanie Lift Co Jeddah Saudi Arabia, 2 units models MC174 and MC285 to London based Danny Laidlaw and a CC1485 6 tonne capacity compact crawler crane to Essex based NRC.

Alan Peck explained that Kranlyft has now been representing Maeda for almost 20 years and currently are the European Master Distributor with sub distributors in most of the mainland European countries. “We also represent Maeda in Russia, the Middle East and Africa which is becoming a good market sector for us.

“Overall in the past three years we have seen increase in business year-on-year but the UK market has seen a slight downturn in business since Brexit. Customer confidence remains high on our products, but but not so much with the current financial situation and the effect of sterling losing ground against the Yen and the Euro. This has seen price increases having to be implemented.“Several key major construction projects have been put on hold that would have produced sales of cranes to facilitate the various contracts.”

“Alongside the Maeda range of cranes on display weere two of the German manufactured Bocker truck and tracked crawler cranes. During the show, City Lifting took delivery of the all new AK46-6000 the new flagship model in the range built on a MAN three-axle, 26t, carrier. This is City Lifting’s fifth Böcker. These cranes have become very popular with our customer base as they fill a gap in the market.

“They offer low running costs coupled with capacities at radius that you would normally require a much larger traditional crane to undertake.

We’ve seen excellent growth in sales and these have been firmly accepted by a number of crane companies in the UK and Ireland.

“We have just reached our third anniversary with Böcker and have seen the product develop into a mainstream crane in the market place.

“Also on display was the new tracked crawler crane model RK36- 2400 first launched at Bauma this year we have secured orders for this innovative new crane. And we start to deliver the first units ordered in August and have stock availability from September both in the UK and Sweden.”

Sennebogen showed in the AGD stand a range of machines, including the 643 R telescopic crawler crane.

Sennebogen showed in the AGD stand a range of machines, including the 643 R telescopic crawler crane.

The rental company Hewden purchased two Tadano ATF 220 G-5, which can be fitted with a telescopic fly jib

The rental company Hewden purchased two Tadano ATF 220 G-5, which can be fitted with a telescopic fly jib

During the show Terex promoted the new family of five-axle all terrain cranes, especially the AC 220-5 with its industry leading 78m boom.

During the show Terex promoted the new family of five-axle all terrain cranes, especially the AC 220-5 with its industry leading 78m boom.

Official European Kato Distributor Rivertek showed three city cranes, the Kato CR-130Ri, Kato CR-200Ri and Kato CR-350Ri

Official European Kato Distributor Rivertek showed three city cranes, the Kato CR-130Ri, Kato CR-200Ri and Kato CR-350Ri