Outlook for construction markets in Japan

24 January 2008Japan offers the world's second largest construction market, behind only the United States. However, it is also one of the slowest growing markets with less than one percent compound annual growth over the past five years.

For decades, Japan was renowned for its fast growth. However, the country’s economy entered a period of turmoil in the late 1980s, and had only begun to recover over the last few years. Growth is still limited.

The country’s weak building climate will continue for some time. Indeed, spending in the construction sector will only increase at a compound annual growth rate (CAGR) of 1.2%, from US$769.8bn in 2006 to US$870.1bn in 2016. Such growth as there is will be fuelled by a growing economy, increasing foreign investment, and potential development of the retail industry.

With virtually no population growth, spending in the residential construction sector will increase at a CAGR of 1.4%, from US$280.1bn in 2006 to US$321.7bn in 2016, driven by an increase in disposable income and the migration of population from rural to urban areas. Population migration from rural to urban areas will create demand for approximately 5m new dwellings by 2013. The demand for renovation work is expected to increase due to an increase in the average age of houses in Japan, boosting spending in the residential sector.

Non-residential construction will be even weaker, growing at a CAGR of 1.1%, from US$489.7bn in 2006 to US$548.5bn in 2016, supported by growth in industries such as transportation and energy and major infrastructure development projects

The non-residential sector can be segmented into buildings and infrastructure. Structural spending will increase at a meagre compound annual growth rate of 0.6%, from US$157.7bn in 2006 to US$167.7bn in 2016. Increasing investment in commercial property from sources including the J-REIT, private funds, and global investors will drive the growth. The retail market is expected to grow due to an increase in consumer spending and expansion plans by major brands despite less space availability at prime sites. In the near term, mega-commercial projects, including the construction of buildings to be used for office and commercial purposes, such as Marunouchi Trust Tower Main Building (37 stories) and Otemachi Area Primary Redevelopment Project Building B (JA) (37 stories), have started, leading to short-term growth in non-residential structures.

The infrastructure segment is expected to grow at a CAGR of 1.4%, from US$332.1bn in 2006 to US$380.7bn in 2016, driven by major infrastructure developments in the transportation and energy sectors. Long-term infrastructure development projects, including construction and development of roads and power plants like the Shinkansen Development Plan (five routes to be completed by 2015) and Tsuruga Power Station (construction of two advanced water-pressurised reactors scheduled to be completed by 2015) will lead to non-residential infrastructure growth.

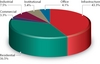

The chart below indicates the composition of construction spending in Japan. The surprising feature is the infrastructure intensity of the Japanese construction industry. Shares this size are more commonly associated with developing countries, and indicates the importance that Japan places on its roads, bridges and energy systems.

Also noteworthy is the share of structural investment being allocated to industrial buildings. This share will fall as Japan migrates to a service economy, but having the manufacturing base as the leading element of structural investment is also more typically a hallmark of developing economies. Taken together, the investment in industrial plant and infrastructure are what allows Japan to remain a world player and export leader despite having developing neighbours with far lower cost structures. This is also fortuitous for the crane industry in Japan, as construction of these facilities tends to be crane intensive.

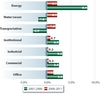

In chart 2, we see the three principal categories of infrastructure spending: energy related, water and sewer, and transportation as well as the four categories of non-residential structures: office, other commercial, industrial and institutional.

While growth slows across the board for non-residential structures, the shift in growth leadership moves from office and industrial to office and institutional as the population ages and the economy shifts to a more service oriented market, typical of mature economies. Within the infrastructure category, the energy sector remains the growth leader, although at a reduced rate as economic growth and industrial production slow, reducing the need for new energy sources. Growth returns to the transportation and water and sewer segments as the nation's fiscal position improves, allowing for greater public spending.

On balance, Japan offers little growth, but remains a huge construction market. The types of structures that are likely to be built over the next several years will be conducive to crane use. However, the bottom line is that Japan is in a holding pattern; while there will not be a need to pull cranes out of the country, neither will there be a compelling reason to add new fleet to the area.