Strong rebound

17 June 2021The demand for used mobile cranes is very strong at the moment, can supply keep up? Sotiris Kanaris reports.

“Demand for secondhand cranes is at an all-time high,” says Zack Ganzell, crane sales manager at US company Bigge Crane and Rigging. “This demand is driven by lack of new crane availability and price increases due to higher raw material costs and supply chain delays.”

At fellow US company Select Crane Sales, they have also identified a strong demand for used machines this year, a stark contrast to the market’s performance last year. The company’s president Jason MacKenzie comments: “While 2020 started off great and the demand was very high, the pandemic greatly limited the amount of machines both new and used that companies were purchasing. There was so much unknown globally, that companies really pulled back and waited to see the long and short-term effects before making any large capital purchases and equipment upgrades. We did see this loosen up towards the end of 2020 and so far, the demand in 2021 has been extremely high.”

He attributes the popularity of used cranes to buyers recognising their value, not only in terms of price but also their immediate availability.

Dutch company Hovago, specialises in the international rental and trade of mobile cranes. International sales manager Tiemen Reitsma says the pandemic was less disruptive than they expected. “Several projects in various countries came to a standstill or were postponed last year, resulting in a decrease in demand in 2020 for used cranes. Demand for new rental cranes was lower than expected. But the market recovered quite well and last year’s postponed projects are being carried out this year.

“And the uncertainty that the Covid-19 crisis brought, made users feel sometimes uneasy about purchasing new cranes. Therefore our business, Hovago is specialised in the bare rental with purchase option, increased. And nowadays when cranes come back from a rental contract, because a customer, for various reasons, was not interested in buying, demand is such that we never have it in our yard for a longer period. Which proofs our point that the demand for good quality, young used cranes is still high and might even be higher than before.”

At Hovago they see demand for used cranes being driven by the US, Europe, as well as some African and Asian countries.

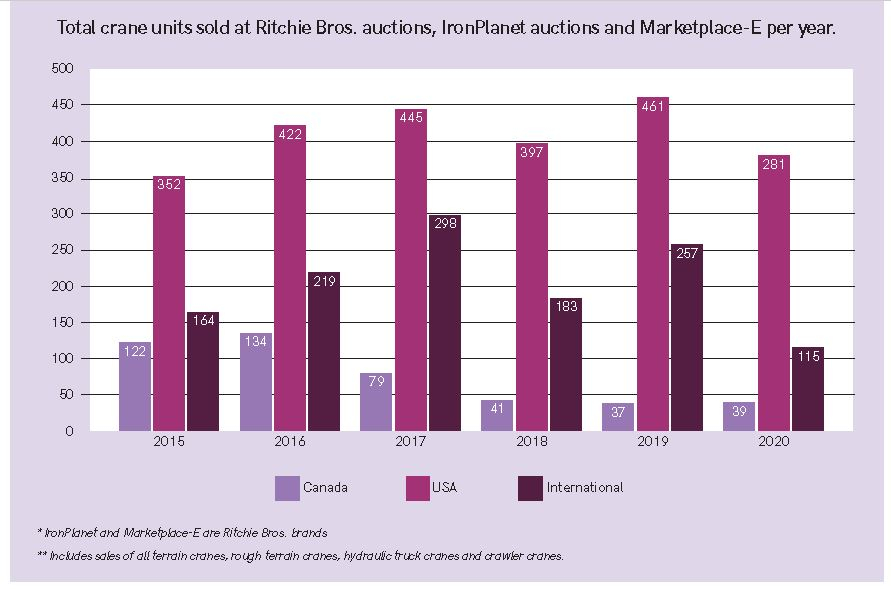

International equipment auction company Ritchie Bros. has witnessed a decrease in the total number of mobile crane units sold in 2020 (755 sold cranes in 2019 versus 435 in 2020). However, the strategic account manager for Heavy Lift and Crane Sector, Piet Kraaijeveld, says that currently, the demand for used cranes is steady and in some countries is increasing.

Indian and Egyptian companies have purchased a large number of units offered in the Dubai online auctions, as the market there is active. He adds that there are many inquiries from Egypt and Mozambique for refinery constructions. The oil and gas industry recovery triggers demand for used younger cranes, particularly from customers in Saudi Arabia and Qatar.

Talking specifically about the Middle East, he says crane rental companies have changed their purchase strategies since the oil shock in 2014. The low number of new projects led to a large number of cranes being underutilised, triggering an influx of used machines in the secondary market, as companies divested assets to re-adjust their balance sheet.

Kraaijeveld explains that now many companies in the region opt for used cranes when they decide to expand their fleet because of the lower total cost of ownership and more immediate availability. It creates opportunities for reserved and unreserved auction channels. He says that companies serving the oil and gas sector choose two or three-year-old machines because there is an age limit of ten years for related contracts.

Some crane rental companies in the region that serve civil projects have started purchasing new Chinese cranes. “We see more end-users buying these cranes as the initial procurement cost is lower compared to the other brands. Nonetheless, European, Japanese, and American manufactured cranes are still very popular among crane businesses.”

In terms of the most popular used mobile cranes, Kraaijeveld says that all-terrain cranes between 60t and 250t are among the most sought after. At Hovago they find that demand for all terrain cranes between 100t and 300t is high. Reitsma says: “And we definitely see an increase in demand for telecrawlers. That market has never been so alive as now. Furthermore we see some demand for rough terrain cranes in Europe. Might that lead to a conclusion that Europe is finally discovering that RTs are a great solution for certain projects?”

He says the machines experiencing a drop in demand are all terrain cranes below 70t capacity. A possible reason for this, according to Reitsma, is that assist cranes requested for wind projects are usually of higher capacity, 200t class and above. “And the smaller cranes are kept in local fleets for the taxi rental,” he added.

Select Crane Sales, established in August 2016, specialises in the sale of new and used cranes including all terrain cranes, hydraulic truck cranes, carry deck cranes, boom trucks, rough terrain cranes, crawler cranes, and tower cranes. It has two full service locations in Florida and New Jersey, USA. MacKenzie says demand for each type varies from market to market, but overall mid-sized all terrain cranes and 30-50USt boom trucks continue to be popular. “This is not to say that other types or sizes are not popular, because we are seeing machines sell and be in demand in most categories of cranes.”

Bigge Crane and Rigging has been selling cranes from its fleet since it entered the crane business over 100 years ago, and has evolved into one of the largest providers of new and used cranes. It sells used cranes all over the world and is finding an increase in activity in Central and South America as well as Africa.

The company sees high demand across many different mobile crane types as well as classes. “We have experienced strong demand in large all terrains (100 to 600USt), crawlers (110- 1200USt), rough terrains (30-160USt) and telecrawlers (35-275USt). The companies that plan well are buying now, prior to the predicted shortage and building their fleet for upcoming work,” says Ganzell.

PRICE HIKE

With used crane sellers experiencing high demand, the question is whether supply can be an issue.

Kraaijeveld finds that in the Middle East, there is currently an oversupply of used cranes, especially crawlers, due to delays and cancellations of oil and gas projects and a lower number of infrastructure projects.

MacKenzie finds that supply in the US has been abundant up until recently. “Certain class and size machines are becoming harder to find, especially when looking for lower hour and later year model. We were anticipating many more machines in the market due to the volatile oil industry but so far, there hasn’t been any major fluctuation in either direction as far as supply is concerned.”

Hovago’s Reitsma finds that supply is lagging behind demand and this has lead to slightly higher prices.

At Bigge they have also seen an increase in the price of used cranes. “Prices dropped in June 2020 but rebounded in March 2021. In fact, pricing of used equipment is up 7.8% in the last two months, and we predict pricing will climb past prepandemic levels,” says Ganzell.

McKenzie has found that competition and the internet has been affecting pricing. “The internet has become a double edged sword. It makes it possible for us to market machines all over the world and sell to places that we have never stepped foot in, but it also allows buyers to see all the machines available on the market and not necessarily purchase from the “dealer” in their immediate area.

“On top of that, you have a lot of equipment brokers that have little to no money out of pocket invested and can sell a machine for less than we are able to due to not having any overhead expense.”

However, at Select Crane Sales they have seen the prices of certain machines increase over the years due to demand as well as currency exchange fluctuations.

The internet has transformed the crane auctions market, with online sales growing for years. Ritchie Bros. says that before 2020, 70% of its global auction sales were already taking place online, and only 30% onsite in its auction theatres. But the pandemic has accelerated the transition.

Kraaijeveld says: “Against a backdrop of the Covid-19 pandemic leading to lockdowns, inconveniencing, and disrupting the operations of many organizations, Ritchie Bros. has seized the opportunity to adapt and evolve. We have transformed our business from an onsite and live auction company to a digital multi-channel business with powerful physical features. The transaction takes place online, but there are auction sites where equipment can be inspected and tested and the local teams ready to provide additional services.”

Since March 2020, all Ritchie Bros. auctions in the EMEA region have been held entirely online due to the Covid-19 pandemic. The company has seen the auction registrations and bidding participation increase dramatically in the last year.

OPTIMISM

All the industry experts interviewed for this article are optimistic about the used crane market’s performance in the next few years.

Kraaijeveld says: “More significant oil and gas industry projects have been sanctioned already, and more are expected next year. This could lead to an impulse for a demand for the used cranes in the Middle East. Also, we see an increase of projects in North Africa, which is typically a region where we see the demand for used equipment.”

Reitsma expects demand for used cranes to increase further over the next year, due to supply of new cranes not being able to meet demand. He explains that post-crisis economy stimulation packages around the world in combination with an increase in renewable projects will lead to many new projects (industrial, energy, infrastructure), increasing the demand for new cranes.

“And since supply of new cranes is limited, the demand for used cranes will definitely also go up. So 2022 will definitely be a good crane year, for new and used business.”

Select Crane Sales’ MacKenzie believes that demand for secondhand cranes will remain strong because of the price of new cranes going up. “As the cost and supply of raw materials goes up, and subsequently driving the price of new machines up, the used market will take a larger role than ever. We also see the bare rental markets increasing due to the cost of ownership and uncertainty in the global economy.”

Bigge Crane and Rigging’s Ganzell says there will always be strong demand for well-maintained secondhand cranes. “Pricing for new cranes will continue to increase, and more importantly, used cranes rent for the same price as new ones. Smart buyers always consider buying used prior to making their investment into a crane for their fleet.”

Bigge Crane and Rigging recently sold this Tadano GR-1200XL to a customer. “Bigge’s Preventative Maintenance Program allows customers the peace of mind knowing that they are buying cranes that have been maintained to the highest standards and are competitively priced,” says crane sales manager Zack Ganzell.

Bigge Crane and Rigging recently sold this Tadano GR-1200XL to a customer. “Bigge’s Preventative Maintenance Program allows customers the peace of mind knowing that they are buying cranes that have been maintained to the highest standards and are competitively priced,” says crane sales manager Zack Ganzell.

International equipment auction company Ritchie Bros. has transformed its business from an onsite and live auction company to a digital multi-channel business with physical features. “The transaction takes place online, but there are auction sites where equipment can be inspected and tested, and the local teams ready to provide additional services,” said strategic account manager for Heavy Lift and Crane Sector, Piet Kraaijeveld.

International equipment auction company Ritchie Bros. has transformed its business from an onsite and live auction company to a digital multi-channel business with physical features. “The transaction takes place online, but there are auction sites where equipment can be inspected and tested, and the local teams ready to provide additional services,” said strategic account manager for Heavy Lift and Crane Sector, Piet Kraaijeveld.