Urban boom

18 December 2017There is no doubt that the Australian crane market, led by urban development, is in recovery mode. The rejuvenation and expansion of Australia’s cities and infrastructure continues unabated, spurring demand for tower cranes, all terrains and mini crawler cranes.

While the mining/resources sector remains weak, reflected in limited demand for RTs, there is light on the horizon with coal miners like Peabody reporting their best results for five years. Stuart Anderson reports from the Crane Industry Council of Australia (CICA) Conference.

For Australia’s crane hire companies the operating environment remains immensely challenging.

Inconsistent road regulations from state to state, massive paperwork/administrative demands from local authorities and contractors, increasingly serious skilled labour shortages, static crane hire rates and demanding crane testing requirements, all contribute to the challenges of running a viable crane hire business.

Fortunately, some headway is being made, albeit slowly. Several effective initiatives recently introduced by the CICA trade association are being warmly welcomed by the crane hire industry.

Over the past three years CICA has developed into a more-cohesive and effective organization. In part this is thanks to the unification of what were largely-independent state associations into state branches of CICA, with the Western Australia branch joining in 2017.

That is not to say that from a regulatory standpoint Australia operates homogeneously, that is still a distant dream. CICA has also become a more effective representative of the industry.

Praise is due to CICA’s CEO Brandon Hitch for developing worthwhile initiatives and helping to unify the organization.

Attendance at this year’s Adelaide Convention, reached 400, up 20% over last year’s Cairns event, reflected the improving health of the industry.

As usual the conference was well-attended by leading international crane executives. Indeed, Terex Cranes CEO Steve Filipov told the conference that he regarded the Australian event as the best on the international crane calendar.

In contrast to last year’s event, the mood at this year’s CICA Convention in Adelaide was distinctly upbeat. Again, the crane owners and crane manufacturers panels were must-see highlights.

The challenges of working conditions facing the Australian crane industry yet again dominated the commentary of the crane owners panel. Nevertheless, all agreed with the comments of Tyson Fraser of major contractor Monadelphous Engineering that there have been “huge developments in safety” due in large part to the significant reduction in manual handling. But, the comments of Chris Kolodziej of Tasmania’s largest crane hirer, Cranes Combined, really captured the mood of the industry.

“There’s a lot more paperwork especially with Tier 1 contractors. It’s very difficult to get paid for these major administrative burdens in the competitive crane hire market”, said Kolodziej. “Some (contractor’s) safety engineers are fresh out of college and often tend to overcomplicate things. It all conspires to make this business less viable”.

On the subject of road regulations, Luke Sharp of Sharp Cranes told the conference that although it remained “hard to get permits in rural areas” things were slowly improving. “We probably didn’t know the right processes at first but CICA has helped us,” he acknowledged.

Luke and Graham Sharp are the second generation of the family firm established in 1974 operating what they claim to be the largest crane fleet in southeast Australia with branches in Mount Gambier and Millicent with their largest crane being a Liebherr LTM 1130-5.1.

In typically forthright manner, Paul Churchill, New South Wales Crane Association chairman, reinforced Sharp’s points, and went further: “No one should be nervous about not knowing all the permit requirements. The NHVR (National Heavy Vehicle Regulator) probably knows less than you. While there are different roadability classes of cranes in each State, how are they going to get a national standard?

The NHVR is overworked and understaffed. They’re going to take over Tasmania by May 2018. We need to get the best points from each state and combine them.”

From Queensland, Joe Conti of Brisbane City Cranes said that his State had suffered a sluggish start to the year. “A lot of builders have folded. We’re often dealing with (contractor’s) people who don’t properly understand the business. Contractors are not looking at the add-on costs of dogmen, etc.”

Echoing the views of crane hirers worldwide, Chris Kolodziej emphasized: “If you don’t stick to your rates, it’s a race to the bottom.”

As in much of the Western world, so-called health and safety-related issues have dramatically increased the costs and time required to do business. Traffic management has become a huge industry employing hundreds of thousands and costing hundreds of millions. Site inductions remain a major time-consuming cost for the industry.

“Many (contractor’s) safety officers are simply justifying their existence – making work for us. We spend around one month a year on inductions with just one of our clients” added Kolodziej.

A major breakthrough has been made in addressing Australia’s crane testing requirements which were threatening to strangle the industry to death. CICA’s latest position paper on major inspections has been universally-praised.

Together with the new Australian Standard AS 2550.5-2016 the new regime adjusts the threshold mandating major ten-year crane inspections and in its place sensibly recommends following manufacturer’s recommendations or as identified as a result of a CraneSafe inspection.

Another thorny problem remains the total lack of uniformity in interpretation of safety requirements amongst contractors and their safety officers. This problem is exacerbated by increasing skilled labour shortages in Australia.

Crane owners feel the impact of this not only in difficulties recruiting and retaining crane operators, dogmen and technicians, but also in rising wages and the daily frustrations they suffer in dealing with inexperienced contractor’s job site personnel.

While there are well thought-out qualifications for operators and riggers as Luke Sharp said, “Some may be able to operate a 600t crawler and do an engineered-lift, but not necessarily adjust to working with a Franna.” Churchill closed the session by challenging crane owners, “Why are we so scared of charging for the engineered-lift plans we develop? Don’t just give them away. They belong to you.”

One initiative begging to be developed is a project to introduce the crane hire industry to school and college students and ultimately invest in an industry-entry training.

The strongest sector of the Australian crane business continues to be high-rise tower crane usage. Although total Australian construction investment was down by approximately 10% in 2015- 2016, the bright spot was multi-level apartment construction which increased by almost 20%. The Rider Levett Bucknall (RLB) Crane Index for Q3 2017 recorded 685 tower cranes in the skylines of Australia’s major CBDs (Central Business Districts) – up from 654 in Q2. This is the highest number since the RLB started in 2012.

Most of the activity is around Sydney, Melbourne and Brisbane, with Sydney adding 16 cranes for a total of 350, Melbourne adding five for 151 and Brisbane adding four for 85.

The increases come despite predictions of a slowdown as the high-rise residential sector comes off a peak. In September 2016 RLB estimated that a record 528 cranes were working on apartment blocks in Sydney, Melbourne and Brisbane.

This they compared to 429 tower cranes working in the major North American cities of Boston, New York, Chicago, San Francisco, Los Angeles, Toronto and Calgary.

The boom in residential construction has been driven primarily by a surge in buildings with over four stories. However, 2017 may end up being the peak.

The slowdown is already being felt in Brisbane where Scott Hutchinson of Hutchinson Builders (commonly known as Hutchies), with annual revenues of AUD1.5bn and a fleet of 35 cranes, recently admitted that they had seen a decline in crane rentals and said: “I think the boom has topped out. We can’t keep on building units at the rate we were going”.

While Favelle-Favco dieselelectric luffing boom tower cranes continue to dominate Australia’s skylines, conventional electric saddle-jib and luffing boom tower cranes are increasingly favored for their environmental benefits and Australia has developed into a significant market for self-erecting cranes. There is also something of an emerging trend for contractors to employ tower cranes away from the centres of the major cities.

For example, Somersby, NSWbased Active Hire became the first Australian company to purchase the new 4t capacity Potain Hup 32-27 self-erector, putting two of these 32m jib units to work on a seven-storey apartment project in Ryde. A new entrant to this market is the Saez H.32 whose Spanish manufacturer is now represented by former Zoomlion distributor principal, Shane Rouhan. Rouhan Enterprises is also promoting Spierings truckmounted tower cranes.

Since its commencement in 2012 the enormous Barangaroo project has dominated Sydney’s urban development. Built on some 22 hectares (54 acres) the project will be dominated by James Packer’s AUD1bn 75-storey Crown Resorts casino and hotel. The project involves over 680,000 sq m of floor space including three commercial office/residential towers, new metro lines and stations, a new ferry hub, scores of bars and restaurants, huge retail space and a one hectare public park, all due for completion by 2024.

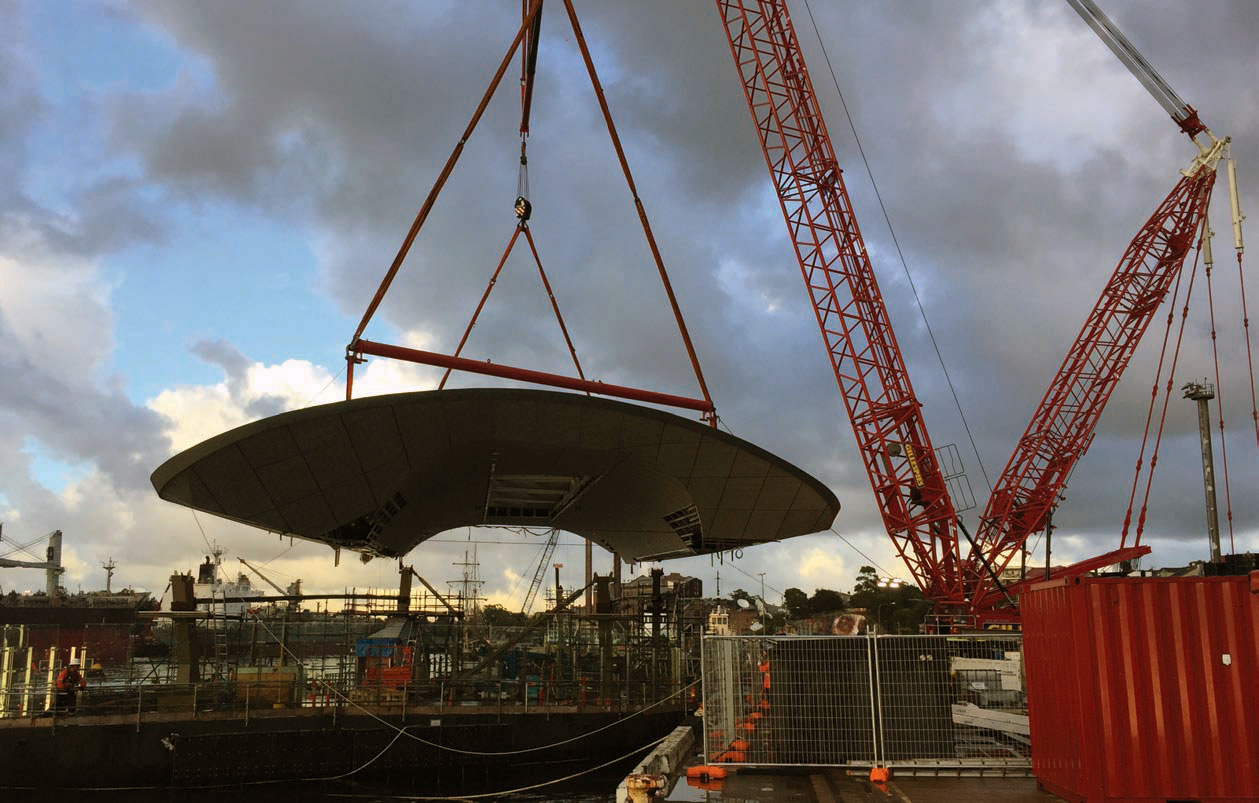

Work on the ferry terminal was the subject of this year’s Lift of the Year competition won by Gillespie’s Crane service with its 350t capacity Liebherr LR 1350/1.

Earlier in the year Gillespie’s largest crane erected two 210t 29m tall towers for Sydney Metro’s new cable-stayed railway. For the job the LR 1350/1 was rigged with 99.6t of counterweight plus 125t suspended on the derrick at 13m radius and was supported by one of Lampson’s 250t Manitowoc 999s as tailing crane.

The Ferry hub project required the handling of two 135t pontoon floats under very exacting crawler ground bearing pressure limits of 400kN/sq mt maximum. For the job a purpose-designed crane pad was constructed to distribute total loads (crane and loads) up to 674t. To handle the large roof elements Gillespie’s developed highly-specialized rigging, mating equalizing triangles reeving a pair of 160t hookblocks under the spreader beam.

The LR 1350/1 itself was rigged with 56m S2 boom, 125t counterweight and 38t of carbody counterweight and 200t of suspended counterweight on the 27m derrick boom and involved a series of changes of derrick counterweight radii to keep within the ground pressure limits.

Notwithstanding the powerful coal lobby, human health environmental considerations are always a major concern across Australia. Such is the case in Port Pirie, a small coastal town of some 15,000 inhabitants about 220km North of Adelaide. Lead smelting has been conducted in Port Pirie since the 1880s and high blood-lead levels have long been a major health concern for the local population.

The importance of the Nyrstar smelting operation to the local economy can scarcely be overstated. The facility employs 2,500 people, pays AUD270m in wages, spins-off an estimated AUD1.6bn to the local economy and contributes approximately AUD100m in annual taxes.

For the past four years it has been the subject of an ambitious project to environmentally-transform the facility.

Nyrstar has proven a good source of work for Max Cranes of Port Augusta that recently added a Tadano ATF 70G-4 to its fleet. Last year, Max supplied its 500t capacity Terex AC 500-2 and 180t Grove GMK 5180 supported by smaller cranes to install various conveyors, pipe racks and other machinery.

A critical phase in the AUD564m transformation came last this year with the arrival from China of a 530t electrostatic precipitator (ESP) measuring 41m x 13m x 21m. The module was the first stage of the new Off-Gas System that draws sulphur-dioxide rich process gas from the Top Submerged Smelter to remove solid particles with ‘clean gas’ continuing into the acid plant process.

Lampson Australia was awarded the contract which revolved around its 2,600USt capacity Transi-Lift LTL- 2600 supported by a 450t (500USt) Manitowoc 2250 with Max-ER, 250t Manitowoc 999 and 200t Manitowoc 777 crawler cranes as well as several 120t Grove RT 9130E rough terrain cranes and 144 axles of Goldhofer SPMTs.

For the critical lift the Transi-Lift was equipped with 134m boom, 2,300t of counterweight and a 24m stinger mounted on 1,800 and 2,000t crawler transporters.

The total load amounted to approximately 630t including about 100t of rigging and was successfully achieved without a hitch. Lampson operates Australia’s largest crawler crane fleet, 100% Manitowocs up to the 750t 18000 MAX-ER and numbering 130 units including Grove RTs.

A return to health

Following the 2011 peak when over two hundred new all terrain cranes were sold, by last year Australian market demand had declined year-by- year to a level of some 25% of that pinnacle.

Thankfully, the decline has been comprehensively-reversed with 2017 sales doubling and likely to comfortably exceed 100 new ATs shipped by year’s end. In terms of size classes, the strongest recoveries have been seen in the 55-to-60t three-axle class (doubled compared to 2016), 200-to-250t five-axle class (tripled versus 2016); and 90-to-100t four-axle class (almost doubled) while demand for new 150t five-axle ATs has strongly rebounded thanks in large part to the appeal of new products, particularly the new Grove GMK 5150L.

Predictably, demand for truck cranes remained at low levels of under ten units for all size classes. Sales are basically confined to three-axle 25t truck cranes and four-axle 60t. While the Chinese manufacturers, particularly Zoomlion, remains the main supplier of small three-axle truck cranes, the newly-introduced 60t capacity Kato and Tadano have triggered recovering interest in these alternatives to all terrains.

In contrast to a few years ago, the presence of the Chinese manufacturers is severely limited. Although there are a number of Zoomlion tower cranes and small truck cranes working in Australia, the activities of the Chinese manufacturer are now primarily focused on concrete pumps.

However, Melbourne-based Gleason Cranes continues to officially represent Zoomlion mobile cranes but is also actively promoting XCMG truck cranes.

Certainly, the slowdown in the mining sector has crippled rough terrain crane demand but pockets remain, sometimes in unlikely sectors. For example, Somersby, NSW-based Borg Manufacturing, a major manufacturer of prefabricated panels, recently-purchased an 80t Tadano GR-800EX and, more surprisingly, a 145t Tadano GR- 1450EX.

While the earlier purchases of this giant RT by Freo and Boddington Crane Hire in the West were in support of mining applications, industrial handling applications continue to emerge, following the delivery of two units to South Australia’s ASC shipyard.

Naturally, the returning health of the Australian market hasn’t failed to garner the attention of the likes of Sarens and Mammoet – both of whom have enjoyed major market presence since 2002.

With the recent opening of a new office in Brisbane – its fourth – and a yard at Perth Naval Base, Mammoet has further expanded its local footprint. Their fleet has been enhanced with the addition of twelve new cranes ranging from Terex- Franna Mac 25s to a 250t Liebherr LTM 1250-5.1.

On the project front, the company recently won the maintenance and shutdown contract for Fortescue Metal group’s Chichester Mining Hub in the Pilbara region in Western Australia.

While acknowledging that 2016 was very slow and involved further downsizing, Sarens Australia Country Manager Luk Roelandts now sees “better times” starting. “There has been a clear uplift in the market with more projects changing status from hold to construction.”

Using a 750t Liebherr LG 1750SX lattice truck crane and 500t LTM 1500-8.1 plus smaller support cranes, Sarens recently completed the installation of 67 wind turbines at the Hornsdale Wind Farm in South Australia and has now moved this equipment to New South Wales for another 75-turbine project.

“To reach Australia’s renewable targets, nearly 2,500 wind turbines must be erected in the next three to five years,” estimates Roelandts.

Wind farm projects are also a key element in the Australian business of the large Spanish ACCIONA Group which in March expanded its Australian footprint with the acquisition of the Geotech Group for €188m (AUD262m).

Three former senior Geotech executives received a 17.6% share in the new business named ACCIONA Geotech Holdings. ACCIONA has already built and operates three wind farms in Victoria, New South Wales and South Australia and is presently working on its fourth – in Mount Gellibrand, Victoria.

The firm’s equipment fleet includes Kobelco and Zoomlion crawler cranes as well as Bauer drill rigs. In making this acquisition ACCIONA estimated the Australian infrastructure market at €90bn (AUD125bn) over the next decade.

New crane business for Manitowoc Australia has also continued at especially strong levels. Building on the widespread success of the GMK 6300L and GMK 6400, Grove’s four and fiveaxle cranes are now carving out impressive market shares.

The 100t capacity GMK 4100L-1 with its 60m boom has definitely hit the spot in Australia with no less than 24 sold to date with 11 already delivered including a unit to Albert Smith’s Universal Cranes and sales to two of Sydney’s major players - Borger (two units) and Melrose (one unit). Also in the Sydney area another major tower crane hirer, Cosmo Cranes added a GMK 4100L- 1 and a GMK 5220 in support of their fleet of Terex-Comedil flat-top and luffing boom towers and Raimondi flat tops.

Manitowoc’s seasoned senior VP of sales, John Stewart told Cranes Today: “The new five-axle 150 and 250t are taking the Australian market by storm.

“So far, we’ve sold fourteen GMK 5250Ls. In Sydney, Borger has two units while in Victoria we’ve sold units to Metcalf and International Cranes as well as to General Crane who also purchased a 450t GMK 7450. The new 150t GMK 5150L has also really taken off. We’ve booked ten orders and started deliveries with units to Melrose in Sydney, Cranes Combined in Tassie as well one unit together with a GMK 6300L to Freo out West. The smaller units are also selling well.”

Contributing to the upsurge in demand have been some of Australia’s longest-established, smaller family-owned crane hire companies.

Two of these, both Queenslanders, favoured Demag’s compact 130t AC-130-5: JIAB Cabooture Crane Hire based in the alluringly-named Deception Bay and Qwest Crane Hire based in Hidden Valley, Yeppoon. The latter recently celebrated its 50th anniversary with the acquisition of a neighboring competitor – Clarke Mobile Crane Service (CMC).

Meanwhile Wagga Mobile Cranes (established in 1975) based in Wagga Wagga, in New South Wales Riverina region has added the popular Liebherr LTM 1055-3.2 to a fleet that also includes Liebherr LTM 1030-2.1, LTM 1100-5.2 and a six-year old LTM 1200-5.1.

Tom Quinlan of Melbourne-based Quinlan meanwhile put his faith in a trio of new Tadanos. Reflecting a broader return to favour of small two-axle ATs, Quinlan’s purchases included a 40t ATF 40G-2 as well as a 100t ATF 100G-4 plus a 60t GT 600EX truck crane.

Tasmania’s Cranes Combined recently also extended its fleet that includes a 2016 ATF 220G-5 with the purchase of a second 40t Tadano AT. One of the last of the now-discontinued GT 600EX truck cranes was acquired by Smithy’s Crane Hire in Cairns; making way for the new GT-600EL which, together with the new 13t GR 130EX mini RT, was featured at the Convention’s crane display.

Following the demise of Walter Wright Cranes with its fleet of some 270 cranes, there has been a significant exodus of used cranes from Australia. This has included the export of several Kobelco CK 2500s and four 400t Manitowoc 16000s, as wind farms have grown in height and weight demanding larger cranes.

Malcolm Smith of Tutt Bryant told Cranes Today that their 700t Manitowoc MLC 650VPC continues to perform very satisfactorily - having recently participated in the handling of a tunnel boring machine at Perth’s Forrestfield Airport Link project.

Crawler crane sales have not completely dried up. Manitowoc’s ‘new’ Queensland distributor TRT (Aust) Pty has placed a pair of 80t (85USt) 8500-1s with Jetty Specialists in Caloundra, Queensland while NQ Civil Contracting - based in Weipa on the York Peninsula in Queensland’s far north - acquired a Manitowoc 11000 100t model.

Manitowoc’s long-standing New Zealand distributor, TRT, established its Australian base in 2016 with the purchase of the well established B&N Cranes servicing business quickly followed with the acquisition of Manitowoc’s former sales and service base in Murarrie,Queensland. The dealership is now managed by B&N’s former-owners Anne and Troy Hand supported by the widely-experienced Phil Chadwick as TIDD’s national sales manager. In addition to these crawler crane sales, TRT (Aust) has also achieved several Grove all terrain crane successes including a break-through sale of a 60t GMK 3060 to Mann’s Logan Crane Hire with branches across Queensland, a 130t GMK 5130-2 and a 150t GMK 5150L to the Centurion mining concern.

Business has, however, continued to improve for tele boom crawler cranes. After a relatively slow 2016, Tadano Oceania is enjoying robust demand for its Tadano-Mantis tele crawler cranes. For the past twelve months a 27t (30-ton) GTC-300EX has been working for Wilberforce, New South Wales-based CitiLink Piling where its main duties have been handling steel cages in support of drill rigs on large residential construction. McLaren Vale, South Australia-based Revolution Crane Hire has acquired a 63t capacity GTC 700EX while Alfasi has a 36t GTC 400EX on demonstration.

Tadano Oceania has also imported their first top-of-the-line 120t GTC 1200EX which has been undergoing local trials in New South Wales. Meanwhile Australia’s largest operator of tele crawler cranes – Preston Hire – is also trialing a GTC 300EX.

These past two years, Australia’s East-Coast urban hi-rise building boom has propelled demand for mini crawler cranes. Anthony Heeks, managing director of Maeda and Sennebogen distributor PACE Cranes told Cranes Today: “Several new customers who previously hired Maedas have purchased new cranes due to their increased workload. 2017 will be our best year ever with a 20% increase in sales.”

According to PACE, Preston Hire now has the world’s fifth largest fleet of Maeda with 74 units, recently augmented with the purchase of two units of Maeda’s new and largest model – the 8.09t capacity MC-815C ‘spider’ – that was unveiled at the conference. Heeks adds that demand for Maeda’s swing cab pick-and-carry models is also strong with eight units sold so-far this year.

While Maeda dominates the large Australian market for mini crawlers with a share of some 80%, PACE Cranes has also established Sennebogen as the market leader in full size tele crawlers.

PACE is in the latter stages of building a totally-new, expanded sales and service headquarters at its Sydney location.

At the conference a rubber mounted Sennebogen 613M was displayed but the main thrust remains on the crawlers with further 613R and 643Rs recently imported as well as the first of the new 30t 633Rs - the first of which was due for delivery in November to New South Wales’s WGC Cranes, adding to a Sennebogen fleet now well into double-figures.

CICA’s crane display provided Australian Crane & Machinery (ACM) with the opportunity to exhibit the 75t Kobelco TK 750FS as well as the new 9t capacity Kobelco CK 90UR-3. The very heavy-duty TK 750FS was equipped with a nicely engineered front-mounted third winch and resplendent in the colours of West Perth, Western Australia-based Wagstaff Piling, joining the firm’s fleet of Link-Belt tele crawlers.

Managing Director Ben Potter gave the conference an overview of ACM’s business that revolves around the growing success of their truck-mounted work platforms. Significantly, in the immediate wake of the production of the last Australian automobile that left Holden’s Adelaide plant on October 20th, Potter proudly announced the construction of a new manufacturing plant at its Campbellfield, Victoria location.

No report on the Australian scene could be complete without an update on the iconic Franna pick-and-carry crane. Terex-Franna General Manager, Danny Black, confirmed to Cranes Today that demand had returned to a positive trend. “We expect to finish 2017 with about 75 cranes delivered”, he said, adding “The number of Frannas on the used market is significantly-reduced with availability of good, low-age (<5-year) models hard to find. Now new crane prices are strengthening and sales increasing”.

The 25t Franna Mac 25-4 remains the clear market leader while the market eagerly awaits the arrival of the 40t three-axle AT 40, the prototype of which was unveiled at last year’s conference. The second prototype was displayed at Adelaide, reflecting lessons learned during the extensive testing programme.

“Following extensive computer simulation and track testing, the machine has a completely redesigned hydrostatic suspension system which has proved to transform the crane”, said Black.

“High speed testing is continuing through the end of this year and we expect to ship the first production units by February”.

It’s clear that Australian customers continue to demand ever-larger pick-and-carry cranes and whether a three-axle machine will develop an important new market class remains the burning question.

Meanwhile Jandakot, Western Austrialia-based DRA Group continues to chip-away with its 4x4 35t ‘Humma’ UV 35-25 and smaller models while, from across the Tasman, TRT’s TIDD PC 25 continues to broaden its clientele base. Most recently Sydney’s Melrose Cranes added three PC 25s to its fleet, while Tom Quinlan’s Melbourne operation added the 25t capacity TIDD and Max Cranes of Port Augusta added its third unit.