Spain explores the world

30 July 2014With domestic demand in Spain as low as it has ever been, crane manufacturers and rental companies are focusing on opportunities overseas. Liliam Molina reports.

The domestic market for cranes and lifting equipment in Spain remains stagnant. Despite ear ly signs of the economy emerging from recession since the end of last year, players in the industr y report that demand is at its low est ever, and there is little hope for recovery in the sector to come in the near future. Whilst rental companies have endured idle equipment costs, Spanish cranes manufacturers have focused on the international trade, and competition is tough.

In January 2014, Mariano Rajoy's People's Party government announced that GDP expanded 0.3% in the last quarter of 2013, the fastest pace in almost six years. The upward trend continued in the period from January to March with 0.4% GDP growth, buoyed by improvement in private consumption, a 1.3% drop in imports compared to 2012, and increased exports. Sales to international markets picked up by 5.2% last year compared to 3,8% in 2012, with a record bill of €223bn (US$303bn).

For the construction sector, which has been in survival mode since the property bubble burst in 2008, sales overseas have helped to stay in business. Jorge Cuartero, CEO of the Spanish Association of Equipment Manufacturers for the Construction and Mining Industries (ANMOPYC), comments: "Currently, international sales account for about 80% of the turnover of Spanish companies in ANMOPYC, whereas in 2008 the figure was about 30%. Last year ANMOPYC company members billed about €1.2bn in machinery export."

This demonstrates the change of mentality in the industry, but Cuartero warns that performance in export sales is not enough to offset the disappearance of the national market for lifting equipment. "The competition in the international market is huge and growing, so companies must remain vigilant and continue to work on internationalisation," he says.

Employment is another casualty of the crisis. Whilst in 2008 the construction sector employed 13,000 people, now it provides jobs for only 7,000.

Demand in short supply

"Our industry is at its minimum low," says ANMOPYC's Cuartero, adding that since 2008 the sector averaged a 30% drop year-on-year. Concrete consumption reveals the decline; "In 2007, consumption of concrete was over 55 million tonne, but last year it was under 11 million tonnes. That's the reality of the construction sector in Spain," he says.

Investment in residential and non-residential projects in Spain is nonexistent, and so is demand for new cranes. The climate in the rental sector is also depressed. The surplus of equipment for hire remains idle.

Jacobo Garcia, vice president of sales in Northern Europe at auctioneers Ritchie Brothers, says: "We've seen many hundreds of mobile cranes coming to our auctions since 2008. Especially in 2010, the supply of used cranes in the Spanish market peaked, with many rental companies having a need to turn their idle units into cash. By the end of 2010 we had sold over 240 cranes that year in Spain, mostly all terrains and rough terrains," says Garcia, adding that most of the idle-sitting cranes were sold to overseas markets and not replaced with new ones.

Ritchie Bros. Auctioneers has auction yards in Ocaña, in the Toledo province, central Spain, and Moncofa, in Valencia.

Owners were left with the big challenge of selling off their surplus units, and buyers were coming from all four corners of the world. "The majority of cranes sold in our Spain auctions in recent years were all terrains and rough terrains between 25 and 100 ton lift capacities," says Garcia, adding that several higher tonnage cranes, even up to a 700 ton all ter rain, have also been auctioned. "These heavier cranes are not equally represented in the market as the lighter cranes. Our upcoming auctions already feature dozens of mobile cranes, most of them under 100 ton, but also some heavier cranes such as the Liebherr LTM1160 160 ton included in our Ocaña auction in June."

The mood is not the best at the moment across Spain. Companies are not keen to reveal information, and the handful of them canvassed to this report agree that the outlook for the domestic market is gloomy, and that any source of growth can be find further afield.

Gruas Roxu is an Asturiasbased rental company with 150 units in the fleet. The company has suffered the drop in demand, but reports that activity is at decent levels with contracts coming primarily from infrastructure works related to industrial and wind power generation.

CEO José Manuel García comments: "Demand for cranes in the 2012-2013 period is flat, and we believe the downturn will continue this year. We're trying to remain in the local market with competitive prices without compromising the quality of the service," he says, adding that popular models range from 100t to 1200t. The crane fleet at Gruas Roxu comprises mobile telescopic, and crawler cranes models ranging 30t to 1200t

Wind farm building has been traditionally a strong sector, providing a steady demand for lifting equipment. Unfortunately, this industry has weakened in recent years in line of the economic nosedive. "Most of the leading companies building wind farms in Spain have for several years trying to win projects overseas as this industry is coming to a halt," comments ANMOYC's Cuartero.

Looking abroad

These market conditions have hard hit small and big players in the industry alike. Global manufacturer Saez is headquartered in Murcia, in south-eastern Spain, where it produces four crane lines, including tower head cranes, flap top and fast-erecting, and climber cranes. Its production output is 600 units per year.

Juan Ballester, sales representative, told Cranes Today that few companies in the group struggled during the downturn with clients carrying debt from leased cranes, however the company has started to see growth in the business. "Our company was affected by the 2008 construction industry downturn, like every other tower crane manufacturer, but it seems that the worst was over in 2010," he says, adding that the company has been growing at an annual rate of 30%-40% for the last couple of years.

"Our strategy has been to help our dealers in Spain to export cranes, and to help them to get established in other markets," says Ballester. "We have helped some of our dealers to open overseas branches by developing solutions like internal climbing systems, or more shipping-efficient and cost-efficient climbing tower sections.

We have also helped some of them by financing part of their new rental fleets overseas."

Looking at the domestic market, Saez's Ballester says demand for new tower cranes is still insignificant, but business is coming from aftermarket sales. "We have clients requiring new accessories like fixing angles, crossbases, jacking cages, climbing sections, as well as spare parts. This demand keeps our factory running quite well," he says, adding that they have started to see a slight improvement in demand on cranes for hire in the international market.

"We see an increase in the demand for bigger capacity cranes, but the mid-sized cranes remain the most demanded, from 120 to 160 meter-ton capacity, and 8 tons of maximum lifting capacity," explains Ballester. He also reports that nearly 300 cranes (both new and pre-owned) were sold last year, nearly 35% up compared to the 220 cranes sold in 2012. Saez has a distribution network in Europe, Middle East, Africa, and Latin America.

"We have recently supplied two brand new Saez TLS 75 16T cranes for the construction of a major viaduct in Villavicencio, Colombia," says Ballester. The cranes will work at hook heights of 140 meters, and due to lack of accessibility for mobiles cranes to that spot, the company has helped its client to build the proper auxiliary means to erect the two tower cranes at the initial height. "We originally thought of building an on-site derrick crane for this purpose, but at this moment we are studying the possibility of using a nearby cable railway. It is definitely a challenge that our engineers are working on. Once erected at the initial configuration, the cranes will be jacked-up to 140 meters of height," he explains.

Demand for tower cranes, says Ballester, started to pick up globally in 2010, and he believes that it will keep growing, but at a slow pace. However, the domestic market for tower cranes has little chance to grow. "We don't expect to sell new tower cranes in Spain until 2018 or 2020," he concludes.

Saez is gearing up its portfolio for the market recovery and is currently developing two models of luffing jib cranes, and a 45-meter jib self-erecting crane. The new product line is scheduled for launch in 2015.

Distribution is key

Brazil, Europe, and North Africa with Morocco, and Algeria, are amongst the most important markets for Spanish crane manufacturers, whilst in the Americas are the US, Mexico, and Chile. The weight of the 'non-traditional' trade partners is higher compared to countries where the industry has been exported in greater volume before. "Every year we realize that markets like France, Italy, and Portugal have dropped demand compared to the growing trend from the Sub-Saharan Africa and Arab markets," comments ANMOYPC's Cuartero, who notes that reputation has played a key role in keeping demand high. "Our products are highly regarded in the international market by offering a very good value for money, allowing us to compete one-toone with leading manufacturers of construction machinery around the world," he adds.

Linden-Comansa, the manufacturer of flap-top and luffingjib tower cranes, has focused its effort to boosts its international network to offset the lack of domestic demand.

"Thanks to development of our network of international sales and exports, we have emerged stronger from the crisis. If we had not made efforts to internationalize the brand before the crisis, we probably would have gone," says Mariano Echavarri, head of marketing at Linden Comansa. "Thanks to our distributors, who know their markets and experience the construction market on a day-to-day basis, we have become a well-known in many countries where it would have been very difficult to get otherwise."

Linden-Comansa reported that turnover in 2013 were up 35% compared to the previous year, including a 67% increase in the number of units sold. "Part of the strategy has been to train dealers to be able to provide technical support, maintenance or assembly to their customer base," explains Echavarri.

The company, headquartered in Huarte, Navarra, in northern Spain, has deployed cranes to a number of job sites around the world. One of its major projects is at the construction of the MahaNakhon tower in Bangkok. An LCL310 model, one of the newest luffing-jib cranes in its portfolio, is at the work site.

The crane has a lift capacity of 24t/m. Also at work is a flat top model 21LC290, with a lift capacity of 18t/m. The unit can reach heights of 325-metre. Other major project is the construction of Montreal University Hospital, in Canada.

Linden-Comansa provided cranes models 21LC550, 21LC290, and two 21LC210 units, each with a lift capacity of 18 t/m.

Echavarri says the company will continue to strengthen its global distribution network because recovery in the domestic demand will not happened in the near future.

"The local economy is improving slightly, but we estimate recovery in the construction sector, and particularly demand for tower cranes, will happen in the long run," says Echavarri.

Foreign crane manufacturers with production facility in Spain also report sales are focused on the global market. German crane manufacturer Liebherr has a production facility in Pamplona operated by Liebherr Industrias Metálicas. The Pamplona site produces the H series construction crane, the 34 K fast-erecting crane and the EC-B small flat-top cranes series.

"The situation in 2012/2013 was flat. There were less investments in residential and nonresidential sectors. The Spanish rental companies did not invest in new tower cranes for their fleets. Almost all products from Liebherr Industrias Metálicas have been exported for the global market," says Hans-Martin Frech, head of marketing at Liebherr. However, he adds that a handful of companies have announced they would resume projects that were on halt.

"We are sure, that we will sell different cranes for the Spanish and Portuguese market during this year," he says.

Liebherr's confidence in the market, says Frech, is based on its sound relationship with its dealer network in Spain, which has remain strong throughout the crisis. "Another benefit is the fact that we managed to maintain our workforce almost in full. Specialists and experts for service, spare parts and maintenance are still acting on behalf of Liebherr Industrias Metálicas in Pamplona. This provides an excellent basis for us for building tower cranes for both Spain and the global market, alongside providing very good customer service."

Current projects with Liebher r cranes on site includes the construction of the Caja Sol building in Sevilla, where two units of 250 EC-B and 6 units of 130 EC-B cranes are in operation. The San Mamés Football stadium in Bilbao has works underway with six units of 280 EC-B cranes, and the Acuatic Centre project in Madrid has two units of 420 EC-H and 4 units of 280 EC-B cranes at work.

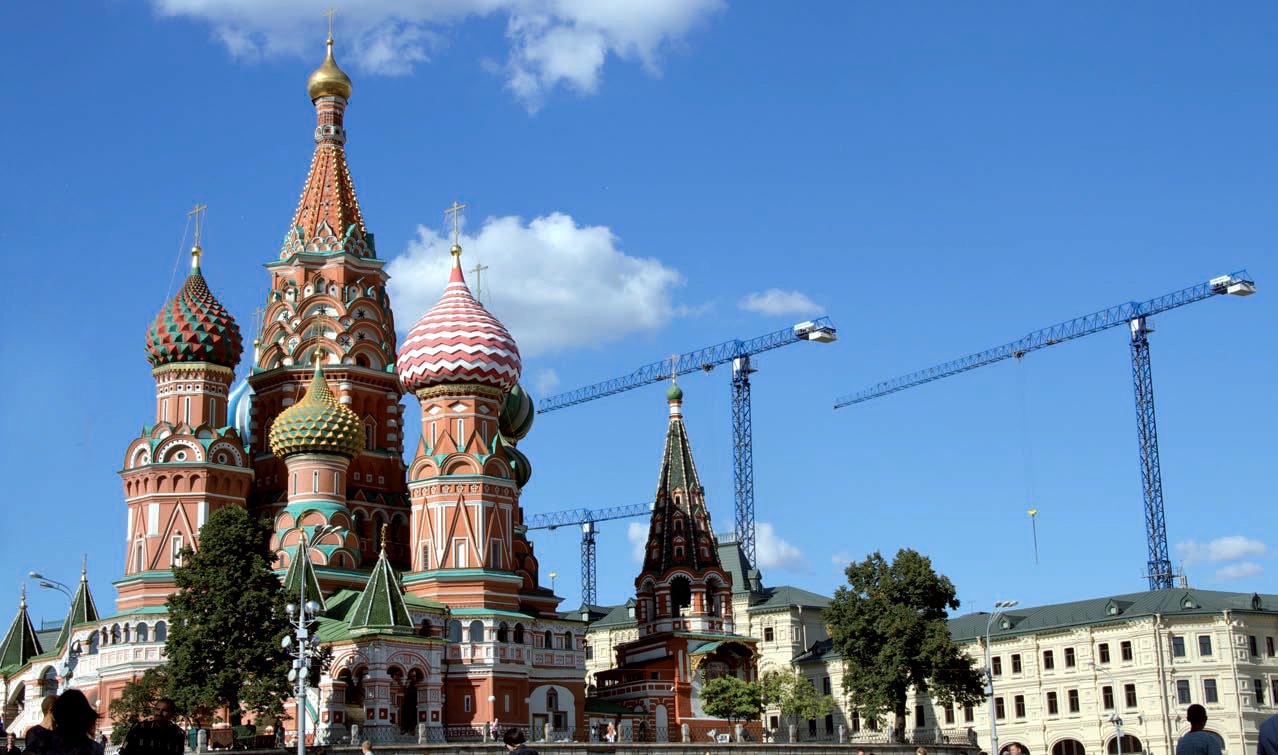

Liebherr's Frech says that in addition to the domestic dealer network, Idustrias Metálicas is expanding distribution in Portugal and across South America. "We believe there is good potential in Russia and South America. Our small flat-top cranes are perfect for the markets in South America, in particular," he says.

Niche markets

Ikusi, the manufacturer of remote controls for industrial lifting and mobile applications has seen the fall of the construction sector across Spain, but reports demand for its products has increased in the international market since late 2013. "Most of our revenue now comes from sales abroad," says Silvia Turné, marketing manager at Ikusi. The company is headquartered in Donostia - San Sebastian, Guipúzcoa in the Basque Country territory.

Turné says the business strategy to remain competitive in the construction sector has been to focus on rental companies of tower cranes in the construction sector with contracts overseas. "We aim to develop specific equipment for mobile applications sector as well as to strengthen our presence in the industrial segment,' she explains.

I-Kontrol is Ikusi's latest product line. The range combines an elaborated design with high configurability and reliability features. Available in three versions (IK2, IK4 IK3 e) each units suit a wide range of applications. "We have recently renewed a contract for the manufacturing of the remote controls for global crane manufacturer Konecranes," concludes Turné.

Product development has been an ally to remain in business, as well as providing engineering assistance to clients. Heavy-lift specialist ALE reports activity in Spain is low, but has signed contracts in challenging projects for infrastructure.

Alberto Quijano Rojo, business development manager at ALE, comments: "The Spanish market continues in slow motion as it has for a number of years. There are many more enquires particularly in the civil sector for projects that are in discussion rather that projects that are confirmed."

Quijano Rojo says much of the demand comes from modernisation rather than new projects. "Industrial plants provide a good long-term scope of work," he notes, adding that one of its key emerging markets is the renewables sector, particularly in solar services.

In spite of the lacklustre demand, ALE's specialist services are at work in two of Spain's biggest bridges currently under construction. One is the bridge over the Ulla River, in Galicia, and a bridge project in the Cádiz province.

Works overseas include the new Forth Bridge in Edinburgh, the 5th bridge over the Orinoco in Venezuela, and the repositioning of the STS cranes in Maersk terminal Algeciras.

"We recently had awarded a project for Tecnicas Reunidas in Antwerp (Belgium) for the Total Refinery. More recently, ALE won the contract for the installation of two 2,700t bridge arches on the 500 metres wide river Wisla in Torun, Poland. The company took home the ESTA award for combined techniques successfully performed at this job site.