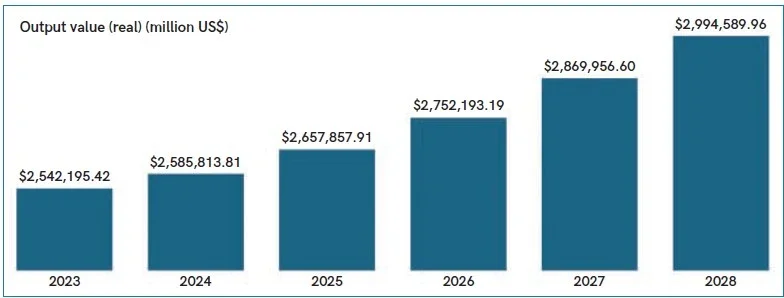

The North American construction market size revenue is projected to reach $2,585.8 billion in 2024 and is expected to grow at a compound annual growth rate of more than 3% over the forecast period (to 2028).

Continued urbanisation, population growth, and the need for modern infrastructure propel demand across residential, commercial, and industrial sectors. Government initiatives for infrastructure development, including transportation, energy, and public facilities, further bolster market growth.

Moreover, increasing focus on sustainability and green building practices shapes the market, with a growing demand for energyefficient and environmentally friendly construction projects.

MANUFACTURING THE FUTURE

The regional construction market is observing a steady build-up in both public and private investments. For instance, as per statistics released by the US White House, nearly $688 billion worth of investments are pledged by private companies as part of an initiative called ‘Manufacturing the Future’.

This commitment to investing in different industrial verticals includes semiconductors and electronics ($245 billion), EVs and batteries ($165 billion), clean energy manufacturing ($77 billion), biomanufacturing ($27 billion), heavy industry ($33 billion), and clean power ($141 billion).

The regional dynamics improved primarily supported by the growth of the US construction sector which accounted for a majority share in real terms in 2023. For example, according to data from the US Census Bureau, the total construction put in place experienced a nearly 7% yearover- year growth in nominal value in 2023, with the non-residential sector emerging as a key driver, showing an annual growth rate of over 19%. This growth in the nonresidential sector, supported by the robust performance of the US construction industry, contributed significantly to regional dynamics, representing a majority share in real terms in 2023.

NEGATIVE GROWTH

On the other hand, the Canadian construction industry showcased a negative growth trajectory in 2023 owing to the declining number of new building permits.

As per the data released by Statistics Canada, the total value of building permits declined by over 7% on a YoY basis in 2023. This downfall was primarily attributed to the 14% YoY fall in new residential building permits.

Over the forecast period, however, the regional growth momentum is likely to pick up with an annual average growth rate (AAGR) of over 3.5% from 2025 to 2028. This growth is predicted to be supported by the increasing focus of the US and Canadian governments on the development of industrial, energy, and infrastructure sectors.

For example, in October 2023, the US government announced the allocation of $61 billion in funds to support investments in critical infrastructure including roads, tunnels, and bridges. Similarly, in November 2023, the government of Canada launched the Critical Minerals Infrastructure Fund (CMIF) of $1.2 billion, to support projects of clean energy, electrification, and transportation over the next seven years.

SECTOR INSIGHTS

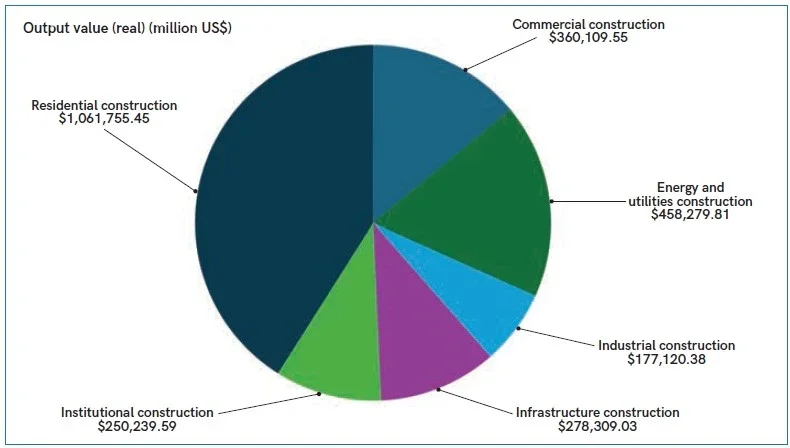

The residential construction sector is predicted to dominate the regional market in terms of output value (Real) in 2024. This sector at a regional level recorded a declining trend in 2022 and 2023, owing to the weak macroeconomic conditions. The high inflationary pressure and elevated mortgage rates directly impacted the new residential building permits during this timeline.

For example, new housing construction in the US declined by 9% in 2023 as compared to the previous year. A similar trend was observed in Canada as well over the mentioned timeframe.

The energy and utilities construction sector is set to emerge as the second-largest segment in 2024 in terms of output value (Real).

The segment registered strong growth in 2023 and is expected to continue on a similar trajectory over the forecast period, aided by the rising spending on clean energy projects. For instance, in April 2024, the US Department of Interior announced that it has permitted over 25 gigawatts of clean energy sites including solar, wind, and geothermal projects.

Similarly, in November 2023, to cut down carbon emissions in Canada, over $161 million was allocated for the construction of a new 230kV transmission line in the Southwest Manitoba region. The project is set to cut down carbon dioxide emissions by around 37%.

The regional commercial construction sector is set to record stable growth with an anticipated annual average growth rate of over 1% from 2025 to 2028.

The segmental growth over the forecast period is set to be supported by the rising investments in data centres. For example, in February 2024, Meta announced its plans to invest approximately $800 million to establish a 700,000-squarefoot facility in Jeffersonville, Indiana. The building of this data centre is set to generate over 1,000 construction jobs during peak construction activity and an additional 100 operational jobs.

The regional infrastructure construction segment is set to record a double-digit YoY growth in 2024 and is projected to follow a similar growth trend over the predicted timeline. This segmental growth is to be aided by continuous investment from the regional governments to expand the transportation network.

For example, in the US, as part of the Rebuilding Infrastructure Program, the government announced an investment of $285 billion for the development of roads, ports, airports, and bridges.

Similarly, in Canada, the Ontario state government in March 2022 announced a ten-year plan to develop a local transportation network. This ten-year investment plan includes an allocation of over $65 billion for the construction of rail corridors, highways, and subways.

The regional institutional construction sector is poised to register a compound annual growth rate of 3.0% over the forecast period. The segmental growth over the predicted timeline will be supported by investments in education and healthcare domains.

For example, in February 2024, the state government of Saskatchewan in Canada awarded a contract worth $898 million to PCL Construction Management Inc. The contract work includes the building of a new acute care tower at Prince Albert Victoria Hospital with features such as a helipad on the roof, operating rooms, and an emergency department.

The industrial segment is predicted to emerge as the smallest category in 2024. The segmental growth over the projected timeframe is to be aided by the mining expansion activities. For instance, in August 2023, ArcelorMittal awarded pit development work for its Mont-Wright mine in the Quebec region to Bird Construction for an undisclosed sum. The contract work includes stripping, drilling, and blasting of 24 million tons of waste and iron ore.

ANALYSIS BY COUNTRY

The North American construction industry registered a growth in output value in real terms in 2023. The market scenario is set to remain in a similar mode in 2024, however, the YoY growth is estimated to decline by approximately 0.6% as compared to the previous year. This decline is partially influenced by the slowdown in the construction sector of Canada in 2024.

The construction sector in Canada is poised to record a negative trajectory in 2024 owing to the expected decline in the domestic housing market.

As per the National Housing Agency, the weak housing conditions are influenced by the surge in borrowing costs making new projects less attractive to developers. Moreover, as per the forecast given by the Canadian Mortgage and Housing Corporation (CMHC), new home construction is estimated to decline from 240,267 units in 2023 to 224,485 units in 2024, a decline of over 6% on a YoY basis.

The US construction sector is estimated to emerge as the dominant regional market in 2024 and is expected to continue its dominance over the projected timeline. The construction market in the US is predicted to be swayed by infrastructure spending. The domestic infrastructure sector is set to register an annual average growth rate (AAGR) of over 11% from 2025 to 2028, supported by the government’s effort to amplify the transportation infrastructure across the country. For example, in January 2024, the federal government announced funding of nearly $5 billion in 37 projects through two grant programmes including National Infrastructure Project Assistance and Infrastructure for Rebuilding America.

Another key sector that is poised to showcase its influence on the US construction market over the forecast period is the energy and utilities category. This segment is projected to record a compound annual growth rate of over 8% over the predicted timeline. The segmental growth is to be primarily driven by the increasing investments in renewable energy projects. For instance, in January 2024, the United States Department of Agriculture (USDA) announced an investment of $157 million across 42 states through the Rural Energy America Program (REAP).

ASSOCIATION SPOTLIGHT: GUIDING LIGHT

Slew of benefits to be gained from industry educational resource, says SC&RA.

On eastern side of the USA, in a southwestern suburb of Washington D.C – the federal capital of the USA, you’ll find a key international trade association dedicated to furthering the causes of the lifting and specialised transportation industries. In case you haven’t yet realised, it’s the SC&RA (Specialized Carriers & Rigging Association), which proudly states its mission is ‘an unwavering commitment to advocate, educate and provide networking opportunities that help its members and overall industry stakeholders operate safely, legally and profitably around the world’.

Beneath its education banner the Association’s produces what it calls ‘lifelong learning resources’; the Association’s dedication to education is evident in its diverse range of educational offerings.

In September 2021, it produced a tool designed to help tower crane companies protect themselves against unfair and biased agreements. Called ‘Understanding tower crane bare rental agreements’ the guide aims to educate as to what certain terms mean, what to look for and how those terms can affect a crane company’s business and insurance liability.

The document covers key details such as: how to read a lessor agreement; agreement provisions to watch out for; sample agreement clause/language; insurance requirements; indemnity or indemnification; liens/payments; dispute resolution procedures; contract checklist; lessee requirements; and an OSHA compliance sample letter.

Building on the success of the tower crane rental guide the Association produced a similar style document but specifically for mobile crane owners called ‘Understanding mobile crane bare rental agreements’.

And as recently as April 2024 SC&RA published its ‘Guide to tower crane procedures’, a document expressly intended to provide best practices to successfully plan, communicate, mitigate risk and identify roles and responsibilities that align with the manufacturer’s recommendations for tower crane assembly, reconfiguration, climbing, tiebacks, foundation design and disassembly procedures.

The impetus for the guide emerged from an audience poll taken within an SC&RA Tower Crane Committee meeting during the Association’s 2023 Annual Conference – in which the audience chose Assembly/ Disassembly & Climbing Procedures as the topic most important to be addressed by the Committee.

The Committee formed a task force that included 15 members from all areas of tower cranes – manufacturers, end-users, general contractors and engineers. The task force was eventually broken into three workgroups – Pre-Planning, Climbing and Assembly/ Disassembly/Reconfiguration.

Splitting the task force into three groups ensured that attention to each section would meet the needs of the intended users, said Tower Crane Committee Chair Peter Juhren, with Morrow Equipment Company.

JR Moran, of Brasfield & Gorrie, LLC, chaired the task force, and refers to the guide as all-inclusive. “From pre-construction planning to job completion,” he says, “this guide covers everything from a bulletpoint perspective that an end-user, a crane provider, a crane manufacturer needs to cover.”

Dan Durrett, with Maxim Crane Works, headed the guide’s Pre-Planning workgroup, and points out that, as with all of SC&RA’s crane education tools, his first hope is that crane users get as much out of them as they can.

“Using equipment you are unfamiliar with can lead to missed steps along the way,” he says. “Providing this guide, and other similar guides like it, hopefully improves planning and use for tower crane and mobile crane users – whether frequently or infrequently. And for users of cranes comprising all sizes and capabilities, the benefits of SC&RA’s tools and educational resources are ultimately felt across the industry – as both a reference and a training guide for companies as well as their customers.”

JOBSITE INSIGHT: BURNING BRIGHT IN JAMESVILLE, NEW YORK STATE, USA

Furnace flue replacement requires pinpoint positioning from Link-Belt 348 Series 2 lattice boom crawler crane.

Syracuse, New York State-based steel project installer JPW Erectors has added a 300-ton (272 tonne) Link-Belt 348 Series 2 lattice boom crawler crane and luffer to its fleet.

The purchase, made in the first quarter of 2024, was received via local Link-Belt Cranes dealer Wood’s CRW.

The 348 Series 2 is one of five lattice crawler cranes owned by JPW Erectors, including a 2013 348 HYLAB 5 with luffing attachment.

“I ran our 348 HYLAB 5 since we got it over ten years ago,” says JPW Erectors, owner/operator, Jody Wozniczka.

“We kept that 348 HYLAB busy, but we really are impressed and happy with the changes in the new style 348 Series 2 with combo top. We have a great relationship with the local dealer Wood’s CRW and were able to trade-in the older HYLAB and really like the functionality and smoothness of putting together this new luffer.”

The job

The crane and luffer were delivered to Onondaga County Resource Recovery Facility in Jamesville, New York State, for a six-month project dismantling and replacing 1,000 ft. (304 m) of kiln stack at the facility.

The facility converts waste-to-energy, an onsite furnace reaches temperatures of 1,800 degrees Fahrenheit (982 Celsius) and can produce up to 39 megawatts of electricity an hour.

The roughly 300 ft. (91.4 m) tall stack has three separate flues that needed replacement. Two flues were required to stay active during the process. Each flue was dismantled in 45 ft. (13.7 m) sections and removed up through the top opening of the stack with the 348 Series 2; sections weighed between 9,000 – 11,000 lbs. (4 082 – 4 989 kg). The replacement sections are carbon steel up until the point they reach the top of the stack where they transition to stainless steel.

“We had very little clearance on the inside when lifting out the old sections and placing the new ones back. At the opening of the stack, at the very top, we have less than a quarter inch all the way around, so it’s very tight,” said Chip Tourot, project manager for the crane division at JPW Erectors.

The 348 Series 2 was fitted with 200 ft. (60.9 m) of luffing boom and 160 ft. (48.7 m) of luffing jib for the project. This attachment provided the needed radius [133 ft. (40.5 m) to the stack] to lift to the top of the stack and lower the old sections for transport.

Another Link-Belt, a 120 ton (110 tonne) 120|RT rough terrain crane was used as an assist crane for multiple lift tripping, loading and offloading old and new flue sections.

Site setup

The close proximity of nearby Rock Cut Road to the south of the location gave JPW Erectors a very small footprint to work from. To the northside of where the crane was to be located was the existing power station.

“We spent a lot of time thinking about the site setup for this project,” explains Tourot. “The customer did borings and we provided extra ground bearing calculations, utilised 3D Liftplan, you name it…”

Raising the bar

“We then realised we’re going to have to raise the pad for the crane four feet. The customer brought in 75 ft. (22.8 m) long ramps and used gravel. JPW Erectors provided crane mats to get things set up correctly.

“The customer was very accommodating in that way, so it went very smoothly, but there was a lot of thought put into where to position the crane. It helps that we had Dale Macklen; he’s just a highly experienced crane operator. I tell people all the time he’s the best in New York State! We had high winds so we utilised a lot of wind charts for this job. And working in upstate New York in January and February you’ve got a lot of weatherrelated elements with Lake Ontario nearby and he just did a really great job,”.

COMPONENT’S SECTOR INSIGHT FROM KINEMATICS

Ken Sessler, director of strategic business development at Phoenix, Arizona, USA-based actuator manufacturer Kinematics, shares his view of the North American crane components market.

From our vantage point we continue to see the North American components market as strong and stable within the cranes market. As a component supplier we believe the cranes market, hindered somewhat in 2023 by rising interest rates, will maintain growth for us over the next five years due to a combination of the need to refresh outdated equipment (in part driven by productivity advances) and the stimulus that the US Inflation Reduction Act will provide, enabling support for the US infrastructure construction market.

At the customer level we are seeing more and more of our OEM partners seeking increased supply chain reliability and manufacturing capability in a supplier. More and more of our customers are looking to engage in supply agreements that ensures reliable supply given the historical volatility.

Rotation specialist Kinematics supplies actuators for a range of industries including lifting cranes, aerial work platform vehicles, and service trucks.