According to Tom Hopgood, senior economist at leading information services company Global Data, the outlook for construction in Western Europe is somewhat subdued. “Dampened demand is fed by weak business and consumer confidence,” Hopgood says. “Interest rates along with high material and labour costs are limiting construction activity across Western Europe. In 2024 the construction output in Western Europe shrank 1.6% in real terms.”

Despite this, however, there are still plenty of large-scale projects in the offing that will require cranes and lifting equipment. According to in its ‘Project Insight – Global Industrial Construction Projects’ report for Q1 2025, the pipeline for industrial construction projects in Western Europe is valued in total at $billion 332.8.

This includes projects at the pre-planning, planning, preexecution and execution stages. The figure for Eastern Europe is similar, though slightly smaller, at $billion 273.1.

The UK and France lead in Western Europe, accounting respectively for 20.5% ($68,334 million) and 13.7% ($45,614 million) of the region’s project pipeline. Germany is close behind, with projects valued at $44,889 million; Finland, Spain and Sweden lead a closely-bunched set of others each with totals in the $20 billion range.

The overall pipeline in Western Europe is skewed towards projects in the earlier stages, says the report, with those in the preplanning and planning stage accounting for 64.9% of projects, totalling $216 billion in value. Assuming all projects move ahead as planned, spending will peak in 2026, at $78.4 billion.

The largest project in the entire European pipeline is the $15 billion Sellafield Plutonium Recycling Plant in Cumbria, England, currently in the planning stage and which also includes the construction of a new MOX fabrication facility, plutonium storage facilities, a substation, a waste disposal facility, and installation of reactor coolant pumps. (As a comparison, the UK’s Hinckley Point C nuclear power station, which has been under construction by EDF since 2017, and is scheduled to go onstream around 2029, has a current estimated completion cost of £46 billion ($57 billion). No fewer than 52 tower cranes have been (or are being) used at the site, as well as mobile and other crane types.

Crane hire specialist Ainscough alone has performed 1000 lifts there using machines ranging from 40t to 750t capacity; ‘Big Carl’, the Sarens SCG-250 machine, has also been a major feature of the site.)

GREEN TECHNOLOGIES

‘Net zero’ targets have largely fuelled a wave of new investment from the private and public sectors in green technologies such as EV production and hydrogen.

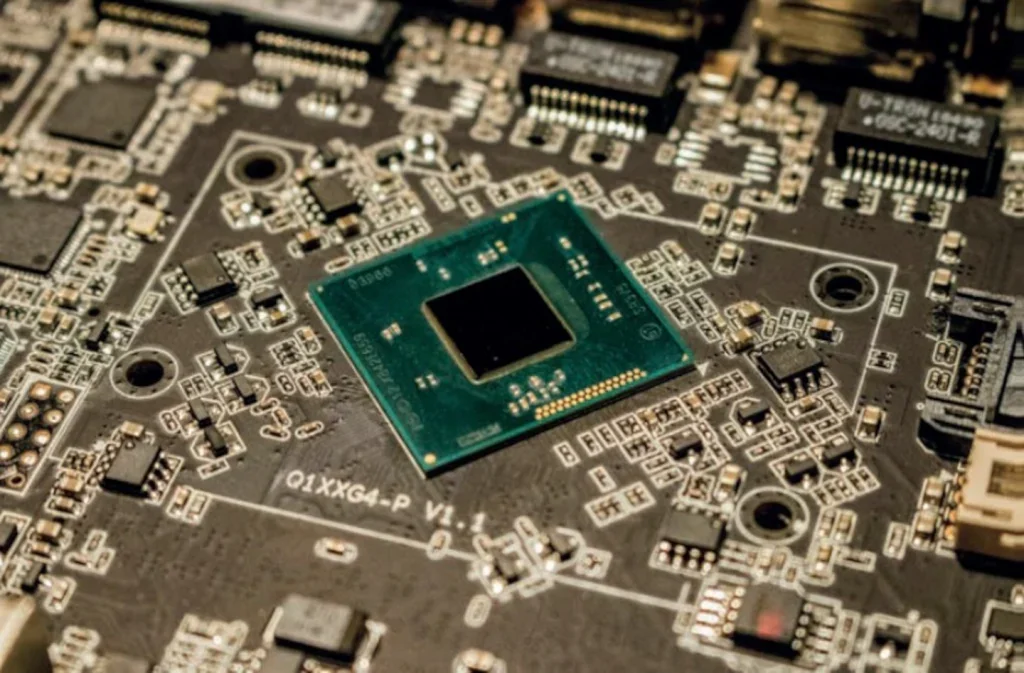

Furthermore, semiconductor shortages have highlighted the need to raise investment in domestic production and become less dependent on foreign supply chains. (The Global Data report was compiled before the uncertainties of the Trump tariffs arose.) The EU signed its Chips Act in early 2023, which will direct $46 billion into semiconductor production. In November 2024, the German government announced its plan to invest approximately $2.1 billion into its domestic semiconductor sector in the form of subsidies, to help semiconductor companies upgrade their production facilities.

Fruits of these initiatives include the Dresden European semiconductor manufacturing plant in Dresden (in the planning stage, value $M11,000), the Crolles plant in France (under construction, $M7,810) a planned chip packaging and assembly plant in Italy, and the Catania silicon carbon wafer manufacturing plant planned for Italy, valued at $M 5,409. All the above are in the top 20 (by value) industrial construction projects in Europe.

Green energy is another area of large-scale investment and upcoming construction needs. Together with fossil-free steel projects they account for no fewer than nine of the remaining top 20 projects. Thus the Bantry Bay Green Energy Plant in Ireland is at the pre-planning stage and valued at $M 9,000. The Megaton 4000 MW Energy Park planned for Denmark is almost as large, at $M 8,700. In the UK, the Swansea Energy and Transport Hub Development is planned to cost $M7,972. The UK’s only other entry in the top 20 is the Woodsmith Potash Mine Infrastructure Development project, valued by the GD report at $M 4,170.

Among the top contractors on such projects are STRABAG, Eiffage Construction, Exyte, Wastbygg Gruppen, Actividades de Construccion y Servicios, Vinci, John Paul Construction, Winvic Construction, and Denys.

RESIDENTIAL CONSTRUCTION

Look at the construction forecast by sectors, residential construction is projected to make up 43.4% of the region’s total construction output in 2025. “This plays a key role in shaping the industry,” says Hopgood. “While for infrastructure construction and commercial construction we now expect account for 21.5% and 15.7% respectively. Declining building permits signal a slowdown in the residential construction sector, which is partly offset by nonresidential construction projects.”

The UK is expected to account for 18.6% of Western Europe’s construction output, and is expected to grow by 0.5% in 2025. Germany and France have 16.7% and 15.2% market share respectively of the region’s construction output. Countries like France, Norway, Sweden, Austria, Germany, Spain Ireland, and Finland are yet to return to their 2019 [i.e. pre-Covid] construction output levels.”