Private equity fund AIF Capital III Shipping and Logistics Ltd has acquired 65 million convertible redeemable preference shares (CRPS) at an issue price of SGD1 (USD0.7). The share issue has raised net proceeds of SGD63.5m (USD44m), Tat Hong said, with 80% to be used to fund its expansion plans in Australia and China, and the remainder used for general corporate and working capital purposes.

As a result, Tat Hong’s issued share capital has risen from SGD187m comprising 504,665,723 ordinary shares to SGD251m comprising 504,665,723 ordinary shares and 65 million CRPS.

“We are truly delighted to welcome AIF Capital as a strategic partner to participate in the group’s future growth,” said Tat Hong’s president and CEO Roland Ng. “This is a positive affirmation of Tat Hong’s established track record in the region and a vote of confidence in the group’s long-term prospects.

“Having secured a strong foothold in our two key markets, Australia and China, through strategic partnerships and acquisitions, we are looking to further expand our presence in these markets to capture value-accretive opportunities arising from both governments’ committed budgets for infrastructural and resource projects.”

These expansions plans have already born fruit, with Tat Hong investing through two of its subsidiaries into a new tower crane joint venture in China, Si Chuan Tat Hong Yuan Zheng Machinery Construction Co. Ltd.

It has invested RMB35m (USD5.1m) through its wholly-owned Tat Hong Equipment (China) and RMB34.65m through its 55%-owned Beijing Tat Hong Zhaomao Equipment Rental Co. Ltd into the joint venture. This will give Tat Hong a 53.8% share in the new firm. The other business cutting in on the new enterprise is Chinese tower crane rental firm Guangzhou Hailin Resources Co. Ltd. Guangzhou Hailin’s founder and major shareholder Yuan Zheng will contribute tower cranes and finance leases related to the tower cranes of Guangzhou Hailin for a 30% stake in Si Chuan.

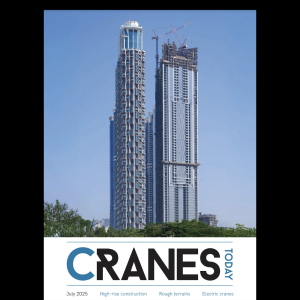

Guangzhou Hailin manages 113 mid- to large-size tower cranes valued at RMB90m. It is a specialist in the erection of power transmission pylons and has benefited from the Chinese stimulus package promoting infrastructure and power sector expenditure.

“Notwithstanding the uncertain outlook for the global economy, we remain optimistic of our long-term growth prospects in China’s tower crane rental market,” said Ng. “Our progressive and steady expansion in China will allow us to further strengthen our foothold in this lucrative market to satisfy the continuing demand for tower crane services.”