Express growth

13 July 2018The Grand Paris Express project aims to improve transport arround the Île-de- France region surrounding Paris.

The project will see four new rapid transit lines added to the region’s transport network, and extend two more. Overall, the project will include 200km of underground railway and 68 new stations. The new lines are scheduled to open over ten years, between 2020 and 2030.

This enormous project will not only extend the metro but will also involve other urban infrastructure being upgraded and extended. The extension of the public transport network alone will cost €35bn. The growth in residential property will double at a rate of 70,000 new apartments per annum.

Mediaco supplied new Liebherr LG 1750 for the project. “Like all crane contractors in the Paris area, we are expecting a healthy rate of orders over the next few years,” says Patrick Meublat, technical director for the crane business at Mediaco in Thieux, a branch offi ce of the company in the north-east of the capital city.

“The jobs for our Liebherr cranes around Paris over the next few years will be dominated by assembling and dismantling tunnel drilling machines and hoisting railway and road bridges.”

The new mobile crane had, by March of this year, completed hoists of a tunnel boring machine for the infrastructure project over the previous few months.

The crane is equipped in compact form with a 35m main boom and a derrick boom, packing sufficient power for these jobs on the growing underground railway construction sites in Paris.

LIebherr says that equipment from all of its construction-related segments will be used on the project; Mediaco alone has 25 Liebherr cranes operating in Paris. Sennebogen too has already seen plenty of work from the project, for both its construction cranes and duty cycle machines.

Since three thirds of the new lines will be underground, specialist machines for underground construction work are required.

Bernhard Kraus, sales director for Sennebogen crane line, says: “With our current portfolio of cranes and duty cycle cranes, we are able to offer the widest range of solutions for the requirements of special underground construction work.”

These include duty cycle cranes for special underground construction, soil and gravel excavation in deep shafts; crawler cranes with lattice boom or telescopic boom for universal use; and high-performance, highly productive “Green Line” material handlers for all tasks associated with constructions sites and material logistics.

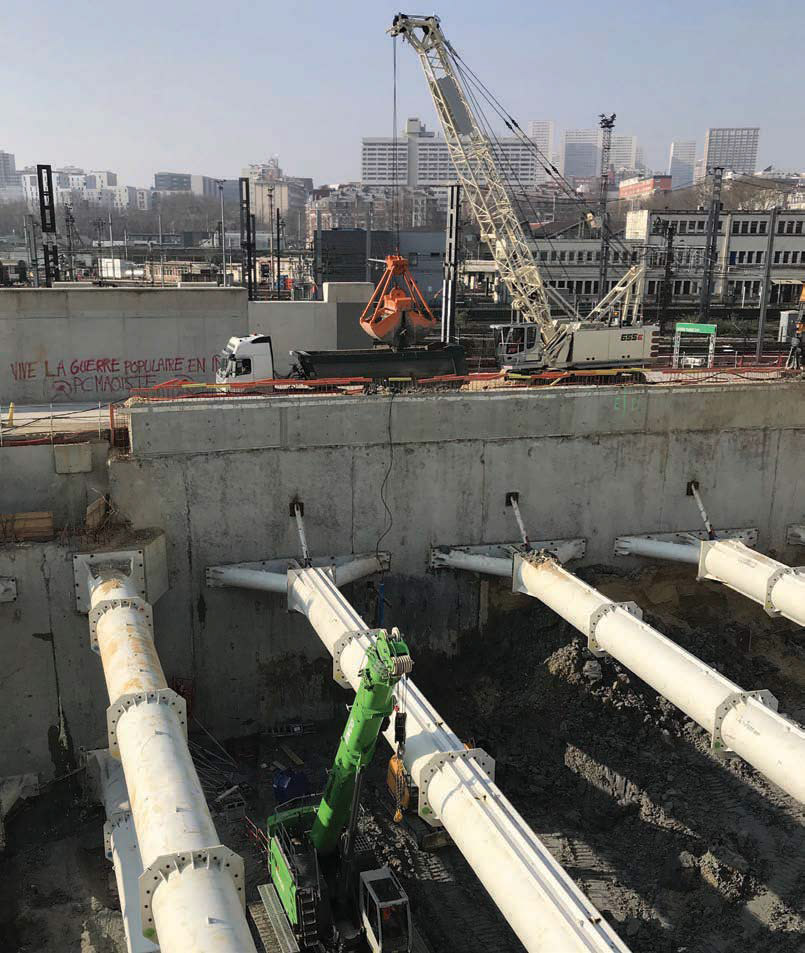

On one site, a 673 E telecrawler and a 655 E duty cycle crane are working alongside each other to remove soil and gravel and do hoisting work where space is confined.

The 673 E is the latest addition to the machine pool of ENCO, a company specialized in the rental of construction equipment. This investment was made to meet the needs of midterm and long-term construction sites.

“There is a growing demand for telescopic crawler cranes in the French market, but there are only few machines,” says Thierry Bouvelot, manager at ENCO. “Sennebogen machines have many benefits: They are easy to transport and to set up because they do not require complex assembly on site, as would be the case with lattice boom cranes.

They can be adapted to any type of terrain, even to most confined spaces within city centres.”

After the diaphragm walls are set up, a lot of soil needs to be removed in order to make space for a large tunnel boring machine.

This work can be handled by hydraulic excavators down to a depth of 20m, but if depths of 50 or even 55m must be reached, a duty cycle crane is the equipment of choice.

Lifting cabs are a unique option of Sennebogen duty cycle cranes. These cabs allow operators a direct view of their work area throughout the entire cycle, a clear benefit in terms of work safety.

Other Sennebogen cranes on use on the project include 624 HD E-Series cranes, being used with equipment like clamshell grabs; a 6140 E, being used by SPIE Fondations with a hydromill trench cutter; and an 850 E-Series, used by SARL Gras to unload materials from barges on the Seine. The machine will first be used to unload sand and gravel, and later to load around 45 million tonnes of excavated material from the project.

Towering opportunites

At Intermat, there was some definite optimism about the French tower crane market.

Manitowoc’s focus at Intermat was largely on tower cranes, as it celebrated the 90th anniversary of French tower crane brand Potain: it had a HUP 40-30 self erector at the entrance to the show, an MDT CCS in the outside area, and a folded HUP 32-27 self erector in the halls. Thibaut Les Besnerais, global product director for tower cranes, said that the addition of Manitowoc’s CCS crane control system was a major upgrade to the already successful MDT topless range. The version on show, available in 12t and 16t capacites, offers customers a powerful crane that is easy to transport and erect. Les Besnerais cited projects like Grand Paris Express as driving demand for the MDT CCS.

He identifed a worldwide trend for bigger cranes, moving away from 6t–8t cranes to 10t, 12t, or higher capacity cranes, driven to a large extent by major infrastruture projects like this, as companies make more use of heavy prefab structures.

John-Pierre Zaffiro, product director for self erectors, said that the two HUP self erectors, launched in 2016 and 2017, had been very successful, offering a compact design with good height-under-hook.

On the smaller HUP, shown inside, Potain demonstrated the GAPO tractor unit. This system makes the self-erector mobile on site, and will soon be offered for the larger HUP. By offering the ability to place cranes where they like, without an additional vehicle, gives Potain a key advantage in the segment, Zaffiro says.

Wolffkran took a stand at the show, for the first time in many years, at least since the company was owned by MAN. The company’s participation gave the company a chance to promote its new French subsidiary.

Duncan Salt, head of sales and services, explained that Wolffkran had first looked for an acquisition target that would give it an entry to the market; but, after being introduced to Ludovic Delcourt, formerly of Arcomet, decided to launch a subsidiary, Wolffkran SAS.

In September, this new business launched with Delcourt as MD. The business’s first focus will be on Paris and the north, but will also be looking south to Lyon and Marseille. The new division is currently working from a 5,000 sqm facility in the north of Paris.

Salt estimates that there are around 5,000 tower cranes in France, split between rental and owner operator businesses.

Salt sees opportunites for both flattop cranes like the 7034 and hammerhead cranes like the 8033, with growing use in the country of luffing jib cranes.

Wolffkran is targetting both sales and rentals. The rental side of the business will start with 120 machines, adding around 20 a year, taken from Wolffkran’s extensive international rental fleet.

The company has worked to make sure its machines are ready for the French market. Some technologies required, like a dead man’s handle, have been adopted as standard; for others, the company is working closely with suppliers, like GEDA for operator elevators, and AGS and ACMS for anti collision systems, which are ‘plug and play’ ready.

Anti-collision systems have become increasingly common around the world. One company that has taken a lead in the sector is SMIE. At Intermat, the company’s new managing director Jean-Charles Delplace, explained SMIE’s latest offerings. He noted that while few other countries require anti-collision systems, many companies are proactively adding them.

Delplace, who had worked previously at SMIE before leaving to start his own business, highlighted SMIE’s ProSite. This, he says, moves the company’s focus from simple anti-collision systems to a jobsite management system. ProSite connects cranes over WiFi, allowing data and alerts to be shared between them.

Projects like the Grand Paris Express, with many cranes working alongside other equipment and railway lines on each jobsite, demand more from companies like SMIE. At Intermat, SMIE was showing off a new approach to ‘special use cases’ that will allow users to design for themselves how the system works. Using a graphical interface similar to an electrical circuit diagram, users can assemble conditonal instructions.

So, for example, when a crane is working over a tunnel shaft, a light will flash as it flies over the opening, to warn workers below. Similar conditions can be set, such as the weight the crane is carrying; the system can take actions in response like sounding an alarm or performing a correction. Where once such special uses could take weeks to be added to a system by SMIE’s R&D department, they can now be added in minutes by the user.

Like anti-collision systems, operator elevators are required for many tower cranes in France (a new regulation, lowering the height at which elevators are required, has been delayed, but is stll coming). John-Louis Olivier, president of SMIE, has recently launched a new company, AMG, or Ascenceur Monte- Grutier.

The company is offering two operator elevators: the cable-based AMG T-1 (built by Tumac, of Sweden) and the AMG T-2, a rack and pinion system. The AMG T-1 is most often fitted onto Potain K mast towers.

Mobile moves

The mobile crane sector was also broadly positive at the show. Just as the increasing use of prefab concrete has pushed demand for bigger tower cranes, so have users started to ask for bigger crawlers.

Jos Verhulst, sales and marketing manager, Europe, at Kobelco, explained that the company has seen good sales recently of 90t and 100t crawlers, rather than the 80t machines that had previously been most popular.

At Intermat, the company announced the sale of three 90/100t CKE900G-2 crawlers to sister companies Valcke of Belgium and Traconord of France. These will be using the cranes to handle concrete sections weighing around 11t: possible on the fixed jib of the CKE900G-2, but not on smaller cranes.

Kobelco handed over a CKE900G-2 to Q Crane & Plant Hire, part of an order comprising a CKE1350-G2, two CKE900-G2s and two CKE1100-G2s.

Q Crane & Plant Hire’s MD Anthony Quinn said: “We bought our first CKE900G-2 in 2016 and our customers have been enthusiastic about its capabilities ever since.

The compact dimensions, ease of transport and assembly, backed up by Kobelco’s high quality engineering and service support, mean this is a great fit with our crane rental fleet, giving us a larger capability in the allimportant 100t lifting sector.”

One of the most enthusiastic exhibitors Cranes Today spoke to at Intermat was Michele Mortarino, of Locatelli. The Italian company was showing a new 50t rough terrain, the GRIL 55.50.

The crane upgrades the company’s medium capacity RT range. On this new crane, Mortarino explained, the company is showing its new hexagonal boom design, which improves performance across the load chart by around 20%. The new boom, supplied by Locatelli parent company Plana, has allowed the company to reduce the overall size of the crane, making the carrier 1.5m less long and the upperstructure more compact.

At Intermat, Locatelli signed its first order for the crane, eight units to Dutch crane firm Van Adrighem, with a further order the next day from another customer.

Describing his sales success in Paris as ‘exciting’, Mortarino said the Italian company had taken an opposite approach from some rivals, focussing on the French show rather than moving away from it.

The market in France, and the broader Western European and North African market served by Intermat, shows stable growth. In three years time it will be interesting to see, after the European economy takes a battering from Brexit and trade wars, whether Intermat continues its decline, or finds a new way to attract the crane industry.