Low oil pressure

28 July 2016Persisting low oil prices have kept the rough terrain crane market soft in 2015 but competition in the larger machine space is rising with demand for these machines remaining strongest, Bernadette Ballantyne reports

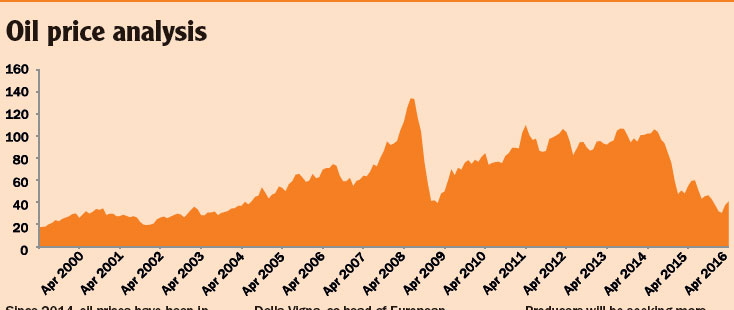

On the whole 2015 was a challenging year for the rough terrain crane segment. Oil prices stayed consistently low, remaining at under $50 per barrel throughout the second half of 2015, reaching a low of just over $30/barrel in February 2016.

“The rough terrain market almost follows the oil price exactly,” says Mike Herbert, head of the rough terrain product line at Manitowoc.

The company has monitored the correlation using their sales data since the 1970s. “If anything there is a slight lag of 6 to 12 months in the sales but the peaks and valleys definitely coincide. So now we are just waiting for the price of oil to come back.”

Interestingly Herbert notes that the latest peak, when prices got back to over $100/barrel in mid 2012, did not lead to a similar peak in rough terrain demand. “ I think that was driven from the large inventories of product on the market from the price peak in 2006- 2008 when there were so many [RTs] built by global manufacturers.

Then work dried up in 2009 and so that was really why we didn’t see the large spike in demand for the product.”

Other manufacturers concur that the oil price affects demand for rough terrain machines with North America and the Middle East being particularly impacted. South America too has been a soft market for many firms but wider economic and political issues have affected demand here for that past few years.

“A lot of the downturn is related to oil being on sharp decline in the past year,” says Matt Dobbs, director of sales at Sany America. “But I have seen a little bit of capturing market share from companies utilising boom trucks in a place where traditionally they might have used rough terrains. It is not a huge part of the impact but it is a factor,” he says.

The versatility of the boom trucks, which have the advantage of being able to drive between sites, along with their lower cost, means that at the small and midsized end of the market there is some crossover with RTs in locations such as steel mills or construction sites with hard standing. However for the higher capacity lifts and on true rough terrain, RTs remain essential equipment.

This is particularly true of the downstream energy sector. Refineries, for example, require large capacity machines for continual maintenance. Although new oil and gas project investments have stalled due to low oil prices, refinery activity has maintained pace as oil production has remained high. It’s this high production that is one of the reasons oil prices remain low.

“I’d say 2015 was a decent year, not like 2008,” says Brian Smoot, product manager for rough terrain cranes at Link-Belt. “We have seen that in the last quarter of 2015 and the first quarter of this year that predominantly our sales have been in the larger capacity machines,” he says explaining that customers have favoured models from 80t and upwards as they seek larger capacity and longer booms. “There are several machines in the larger classes, we offer four in the over 100USt class,” he says noting that this is more than other manufacturers.

“The most popular models are the 80-100t class for construction. For power generation work, we have seen more and more of the 80130 and 80150 with the longer booms.”

Link-Belt’s RTC-80130 Series II and RTC-80150 Series II machines are among the largest on the market with lift capacities of 120t (130USt) and 135t (150USt) respectively.

The larger machine in particular has been among the company’s best sellers. “We have done very well with those machines and demand has shifted a lot over the last two to three years to power plants and refineries. The overall height of both machines, their ability to pick and carry and their capacities are unbeatable,” he says.

Japan’s Tadano, which boasts the largest capacity rough terrain crane on the market at the moment, the 145t (160USt) capacity GR-1600XL-2, says that in North America demand for the machine has kept “strong momentum”.

Outside of the US the machine is known as the GR-1450EX-2 and its main markets are Australia and the Middle East however there has also been demand for this model in the Philippines and Singapore for plant maintenance.

Terex says that demand for its longer boom machines, for example the Quadstar 1075L rather than the Quadstar 1075 and the RT 45L has been consistent from from industrial construction companies and has also been consistent for its mediumlarge capacity RT cranes (45t-75t).

New launches

Given the reported strong demand for larger rough terrain cranes it is not surprising that some manufacturers are targeting this section of the market. Sany revealed to Cranes Today that it is working on a new crane in the 110-130USt range. “When you get into the larger rough terrains there are not as many players and not as many models, so I think it is a good opportunity to go and take some market share in that class,” says Dobbs.

The new machine will be available globally he says but is mainly targeted at North America. “We don’t hear requests for 130USt rough terrains anywhere else but we do here, for work in refineries and oil and gas sector, in shipyards, and on steel yards for heavier pieces and components.”

The company is planning to have the machine available by the end of 2016 with an official launch at Conexpo in March 2017. Although Dobbs wouldn’t reveal any specifications he confirmed that the machine will adhere to the Sany philosophy of form follows function. “Simplicity and reliability is our first priority. In terms of form and function it won’t be a lot different [to the current largest model the SRC885] but it does have a new cab that we have developed for our cranes. In terms of reach we definitely want to be competitive with the models in that class,” says Dobbs.

At the same time German crane manufacturer Liebherr confirmed to Cranes Today that it too is preparing to re-enter the rough terrain sales market. Given that the development onus among major manufacturers is on the larger machine size it is expected that the manufacturer will focus its efforts in this area.

Link-Belt tells Cranes Today that it will continue with its aim of announcing new launches at each big trade show. ConExpo could be the location for a follow up to the 100|RT launched in October 2015 and presented at Bauma. “We are always working on new things,” says Smoot.

“This [the 100|RT] is the first of our next generation. If we came out with something new in the next year or so we’d announce at Expo.”

The new naming system illustrates the fact that 100|RT is a new generation crane with a longer boom. “When we set out to design it we spent 18 months doing what we call ‘voice of the customer’- talking to end users all over the world. So a lot of the design is driven by the end users. They wanted remote access, self diagnosis and a longer boom.

This has 164ft (50m) of boom -10ft longer than the latest competitor,” says Smoot.

The newest 90t capacity crane has a maximum tip height of 261.7ft (79.8m). “It is no secret that to get a longer boom you have to move to pin and latch style boom. Full power is nice for the simplicity, but boom length is limited with full power.

That’s because of the additional weight of the cylinders and cables inside of a full power boom – which greatly reduces capacity. What a lot of people are not familiar with about our pin and latching booms is that we give you the flexibility of a full power boom, but with the benefits of a pin and latch boom. So even though it is a pin and latch boom, you can scope it in and out and stop anywhere you want as opposed to the competition where you have to be pinned off or have a greatly reduced telescoping capacity.”

What this also means says Smoot, is that there is no sudden capacity spike once the pin is in – making the crane more versatile. “With us if you can pick it you can scope it along the entire boom length. We designed our telescopic boom to be able to handle a full chart of capacities,” he says.

Another firm to showcase its latest rough terrain development at Bauma was Terex which launched the new 80t capacity Terex RT 90. Its five section 47m long boom is fully hydraulic and the firm has enhanced the control system with integrated diagnostics, a redesigned cab which has an 18-degree tilt and an easy access flat deck for improved visibility. “It fits the market demand in two ways. One by providing a crane in the high capacity range, with very competitive load charts and also by providing a crane with a long reach,” says Angelo Cosmo, product marketing manager, Terex.

He says that the development was focused along three themes: Safety – for example the top deck has no obstacles that may cause a tripping hazard for the operator walking in and out of the cabin; Cost efficiency, for example the improvements in transportability; and finally the crane complies with European and US regulations and is available with Tier 4f and Tier 3 engines. This will help to sustain the residual value of the crane, explains Cosmo.

“This is the first model of a global family of RT, which we are convinced will be very successful with our customers. The feedback at Bauma was great: a Terex authorized distributor showed their belief in the product by placing a 12 unit order,” says Cosmo. The customer, US based Bigge Crane and Rigging, said it was “thrilled” with the new RT 90.

New generation

Terex and Link-Belt are not the only manufacturers re-launching the rough terrain crane line. Manitowoc too announced the first of its new generation of rough terrain model in 2016, the GRT 8100. “We always felt like there was a gap in our capacity range.

“Before launching the GRT 8100 we had the RT8-90E, which was an 80t crane. From there the next bigger crane in the range was a 120t RT 9130E-2 so we saw that we had an opportunity to take advantage and we had a lot of feedback from customers globally that said we needed a product to offer in that range,” says Herbert.

With a 43m boom length on the existing RTE 90 the firm could see that the machine needed more length to stay competitive. The GRT 8100 has a 47m boom. It was designed using a new philosophy intended to both enhance production and make the cranes more reliable. “We have started to develop all the products and validate the components at our new product verification centre at Shady Grove.

The GRT 8100 was the first entirely new crane to undergo this design process. So in the spirit of how we verify reliability and design new products we have rebranded to really signify the new products that we will be developing going forward using GRT for Grove Rough Terrain,” says Herbert.

Rather than testing the components as part of the final prototype testing at the end of production the firm has begun testing components before and during the crane build.

“The verification of the components has paid dividends because we found issues and were able to take corrective action before we ever built the first production machine so those issues will never make it to the field and become pain for our customers,” says Herbert.

Also at Bauma, Manitowoc launched the GRT 880, which is similar to the 8100 but has a shorter four section boom and will be available later this year.

“Some customers don’t need the 47m length so the 880 is a more economic solution when that boom length is not required. It is still a very strong crane,” he says.

A notable difference between Manitowoc and some of its competitors is that the firm has opted to keep its larger cranes as two axle carriers, rather than moving to three.

Herbert says this makes the machines more manoeuvrable on site. Competitors however say that three axle cranes are more transportable.

Looking ahead Manitowoc is set to put a lot of focus onto its rough terrain product development in 2016. This is despite 2015 having been the lowest year in terms of demand for rough terrains since 2011. The challenging conditions in the crane business have already led the firm to undertake a restructuring and reduce staff numbers at its US production facilities at Shady Grove and in Wisconsin. In January 2016 it also announced that it was suspending production operations at its Passo Fundo facility in Brazil where it assembled rough terrain cranes for the South American market. “Unfortunately it has been painful and we have had to reduce staff numbers a lot. We understand that there is certain right sizing that needs to happen in the business though these peaks and valleys and it is a difficult business to be in from that respect - trying to balance demand and manufacturing capacity,” says Herbert.

First quarter results for the year show that the restructuring is working with operating earnings of $9.5m for the first quarter, compared to a loss of $7.3m in the same period in 2015. This resulted in an operating margin of 2.2 percent for the first quarter of 2016 versus -1.8 percent for the first quarter of 2015. “Firstquarter 2016 operating margins were positively impacted through plant rationalizations, reductions in force and other operating efficiencies,” said the company in its earnings statement.

Global issues

For companies headquartered in the US, income from international operations has been negatively affected by the fall of many currencies against the dollar. For Japan’s Tadano though the weak yen against the dollar assisted the firm in making a large profit in North America in 2015. Sales for its third quarter 2015 showed a 4% rise on the same period in 2014. At the same time the company reported strong momentum in the US market with sales remaining flat against a decline in overall demand meaning that the company effectively increased its market share in North America.

At the same time demand in Japan has remained strong. “Our forecast says the demand of RC [rough terrain crane] in Japanese market would peak in 2015 and might keep higher demand than usual until 2018 thanks to special demand of construction work for Tokyo Olympic games in 2020,” says Takuji Murakami, general manager of the Marketing Department at Tadano. “However, after 2018 which would go to final stage of construction for Olympic games, the demand forecast is not clear.”

Globally however Murakami says that the company expects demand for rough terrain cranes to shrink in 2016 and remain low for “some years” thanks to the oil price reduction, the slowdown of the Chinese economy affecting not only Asia but also the US, and market price reductions in natural resources hitting markets such as Australia, South America and Africa. Furthermore Murakami points to the recession in South America slowing demand in this market for used North American cranes which in turn has slowed the replacement crane market in the US.

“These three factors push down the global demand of RC. However, the oil production does not reduced so that we think the demand of RC in downstream like refinery, chemical plant keeps going on,” he says.

Most firms agree that 2016 looks likely to be a flat year for rough terrain sales in general.

“Overall, we expect a stable demand for rough terrain cranes globally in 2016,” says Cosmo of Terex. “But some of our historic geographic markets show increasing demand. We are seeing this in our sales figures and our production facilities are following it up to deliver to our customers.”

However he notes that 2016 started with a softer Q1 compared to 2015. “We expect a hinge point somewhere in the second half of 2016 . We have noted an increase of the demand of RT’s in the last months and numbers seems to be higher than expected in our forecasts,” he says noting that the majority of demand for Terex rough terrains today is in EMEAR (Europe, Middle East, Africa and Russia) region. “For us it is by far the number one geography. But there was a shift over time: EMEAR took the top position over North America,” says Cosmo who points out that the main applications for the Terex range of rough terrain cranes is in the oil and mining sector, but they are also used in long term jobsites like road construction.

Construction boost

Road construction in North America in particular is set for a major boost after the government passed the Fixing America’s Surface Transportation (FAST) Act in December 2015 setting out the level of investment in transport infrastructure for the next five years. Of the $305bn budget an average annual investment of $57.5bn is to be directed into highways and transit related infrastructure over the next five years. Major multi-billion dollar roads, bridges and upgrades are all moving through planning stages. “I have no crystal ball but we certainly hope to see some of the highway jobs move forward and see demand for smaller machines pick up. Right now, activity is the best for the 100T and above,” says Link-Belt’s Smoot.

Another side effect of the competitive market is pressure on pricing. “The market is very competitive. Dealers are sitting on more inventory than manufacturers would like so it slows down manufacturing and the supply chain and that then drives down prices and creates financial incentives and floor plan incentives and those sorts of things,” says Dobbs of Sany America.

“We are trying to be somewhat conservative in terms of the supply and demand, keep a good control over inventory levels and we have to get as aggressive and competitive as we can out there from a pricing and sales standpoint.

Of course customer satisfaction and support after the sale is a top priority at Sany.”

Overall the rough terrain crane market has had a turbulent few years but expectation in the market is that oil prices have bottomed out and the worst of times are behind the industry.

The leading manufacturers are using the market trough to reinvigorate their products focussing on reliability, capacity, reach, safety and comfort, whilst also ensuring that they stay competitive on pricing.

With a raft of new launches in the larger end of the market set for later this year and early 2017, it is an interesting time for the rough terrain segment. The good news is that an oil price recovery is inevitable, and this will lead to greater rough terrain crane demand, the only question is when.

Oil price analysis

Since 2014, oil prices have been in progressive decline. Although there have been small rises, the overall trend has been a fall in the spot price which dropped from $100.82/barrel in February 2014 to $30.32/barrel in February 2016. Today the price is hovering at around $40/barrel which is where the US Energy Information Administration expects it to stay in 2016. With the rough terrain crane market showing strong correlation with the price of oil, expectations of a stable year from manufacturers seem to be reasonable.

Energy analysts are describing 2016 as a “transformational” year for the energy industry. Michele Della Vigna, co-head of European Equity Research and Goldman Sachs Research says that starting the year with a 1mb/d oil oversupply will take all of the full 12 months to digest before the market reaches a new equilibrium at the end of the year.

“This equilibrium will have a more balanced supply market, but it is still doing to be a dynamic equilibrium.

Dynamic because the oil price required to get the right amount of new production is going to be determined by the cost and by the efficiency in the industry. This is why we think that form here we are going to be in a new oil order that will be driven by a ‘low for longer’ oil price.”

Producers will be seeking more efficiencies and delivering fewer, more complex and expensive projects. At the same time OPEC has decided not to cut production in a bid to maintain and gain market share from non-OPEC producers.

“The position that we are likely to be in by the end of 2016 is a more balanced physical market but a supply chain that is still highly deflationary, and the full equilibrium price over time will keep shifting lower,” says Della Vigna.

In 2017 the EIA expects that lower forecast inventory builds will see a moderate price recovery with the oil price rising to $47/barrel in late 2017.

A Link-Belt 100|RT lifts shoring tower sections at the new Detroit Events Center construction in Detroit, Michigan. New outrigger and upper cab lights can be used for early morning set up.

A Link-Belt 100|RT lifts shoring tower sections at the new Detroit Events Center construction in Detroit, Michigan. New outrigger and upper cab lights can be used for early morning set up.